การลงทุน

บัญชีหุ้นกู้อีซี่ดี

บริการรับฝากหุ้นกู้แบบไร้ใบ

ไม่ต้องเก็บรักษาใบหุ้นกู้อีกต่อไป

บนแอป SCB EASY

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

การใช้และการจัดการคุกกี้

ธนาคารมีการใช้เทคโนโลยี เช่น คุกกี้ (cookies) และเทคโนโลยีที่คล้ายคลึงกันบนเว็บไซต์ของธนาคาร เพื่อสร้างประสบการณ์การใช้งานเว็บไซต์ของท่านให้ดียิ่งขึ้น โปรดอ่านรายละเอียดเพิ่มเติมที่ นโยบายการใช้คุกกี้ของธนาคาร

เปิดเส้นทางสู่จักรวาลการลงทุน

กับกองทุนคัดสรรจากหลากหลายบลจ.ชั้นนำ บนแอป SCB EASY ครบ จบ ในที่เดียว

จักรวาลการลงทุนในกองทุนรวมทุกวันนี้ พัฒนาไปไกล

20 ปีก่อน ... หากสนใจซื้อกองทุนรวมของบริษัทหลักทรัพย์จัดการกองทุน (“บลจ.”)แห่งไหน ก็ต้องไปซื้อผ่านธนาคารที่ทำหน้าที่เป็นตัวแทนสนับสนุนการขายให้กับบลจ.แห่งนั้น หากต้องการซื้อกองทุนเด็ด กองทุนดัง ผลประกอบการย้อนหลังดี กำลังเป็นที่ต้องการของนักลงทุนแต่เป็นกองทุนที่มาจาก บลจ.หลายๆแห่ง นักลงทุนก็ต้องเดินสายเปิดบัญชีกองทุน กรอกเอกสาร ผูกบัญชีซื้อขายกองทุนเข้ากับบัญชีเงินฝากออมทรัพย์ธนาคารกับสารพัดบลจ. กับธนาคารหลายแห่งตามไปด้วย เป็นยุคที่สมุดบัญชีกองทุนและสมุดบัญชีออมทรัพย์จากสารพัดธนาคาร มัดรวมกันอย่างหนา

หนึ่ง...ซื้อผ่านบริษัทหลักทรัพย์ (“บล.”) แต่ถ้าจะซื้อกองทุนหลาย ๆ บลจ. ก็อาจต้องกรอกฟอร์มขอเปิดเลขที่ผู้ถือหน่วยของหลายบลจ. ซึ่งแบบฟอร์มซื้อขายก็ต่างกันไป เพราะยังคงเป็นการเปิดบัญชีตรงกับบลจ.โดยผ่านบล. ที่ทำหน้าที่เป็นตัวแทนสนับสนุนการขายเท่านั้น ทำให้ผู้ลงทุนมักบ่นถึงความไม่สะดวก หรือ สอง...ซื้อผ่านบริษัทหลักทรัพย์นายหน้าซื้อขายหน่วยลงทุน (“บลน.”) ซึ่งบางครั้งก็สร้างความสับสนให้กับนักลงทุนมือใหม่อยู่ไม่น้อย เพราะความคุ้นเคยกับการทำธุรกรรมการลงทุนผ่านธนาคารพาณิชย์มากกว่า ทำให้นอกจากนักลงทุนจะต้องเลือกกองทุนรวมที่จะลงทุนแล้ว ยังต้องเลือกช่องทางการเปิดบัญชีกองทุนที่มีหลากหลาย เป็นปัญหาทางเลือกที่เยอะเกินไปอีก

ปัจจุบัน...ทางเลือกในการซื้อกองทุนรวมเปิดกว้าง กับกองทุนคัดสรรจากหลากหลายบลจ.ชั้นนำ เพียงเปิดบัญชีซื้อขายกองทุนผ่านช่องทางธนาคารที่เราเชื่อมั่น เพียงแห่งเดียว

ทุกวันนี้ ลูกค้าสามารถเปิด “บัญชีกองทุน” กับธนาคาร แล้วธนาคารจะทำหน้าที่เป็นตัวแทนของเราในการทำธุรกรรมต่างๆ โดยเราไม่ต้องติดต่อหลายบลจ.ให้วุ่นวาย อีกทั้งข้อมูลส่วนบุคคลของเราก็ถูกเก็บรักษาเป็นความลับ ไม่ถูกส่งต่อไปยังบลจ.ต่างๆ โดยบัญชีกองทุนที่เปิดกับธนาคารรูปแบบนี้ เรียกว่า “บัญชีซื้อขายหน่วยลงทุนแบบไม่เปิดเผยชื่อผู้ถือหน่วยลงทุน (Omnibus Account)” นั่นเอง

รูปแบบดั้งเดิมที่เราคุ้นเคยกันดีคือ บลจ.ขายผ่านช่องทางธนาคารซึ่งเป็นบริษัทแม่ของบลจ.เอง ดังนั้น ธนาคาร ก็คือ ผู้สนับสนุนการขายหรือรับซื้อคืนหน่วยลงทุน (Selling Agent) มีช่องทางติดต่อลูกค้า เช่น แอป และสาขาธนาคาร ในปัจจุบันอุตสาหกรรมกองทุนรวมพัฒนาไปมาก ฝั่งธนาคารซึ่งมีความสัมพันธ์กับลูกค้าโดยตรง ก็สามารถนำสินค้ากองทุนดีๆ จากหลากหลายบลจ. มาเสิร์ฟให้นักลงทุน ได้เลือกสรรลงทุนอย่างหลากหลาย โดยธนาคารจะเก็บบัญชีซื้อขายหน่วยลงทุนแบบไม่เปิดเผยชื่อผู้ถือหน่วยลงทุน (Omnibus Account) ของลูกค้า แยกต่างหากกับทรัพย์สินของธนาคาร นอกจากนี้ หากผู้ลงทุนเปลี่ยนที่อยู่หรือเบอร์ติดต่อ โทรศัพท์ ก็แจ้งกับธนาคารได้เลย ไม่ต้องไล่แจ้งเปลี่ยนกับ บลจ.ต่างๆ ทีละแห่งด้วยตนเอง ทำให้ตอบโจทย์ทั้งด้านความสะดวก และความปลอดภัยให้กับผู้ลงทุนในกองทุนรวม

สรุปบัญชีซื้อขายหน่วยลงทุนแบบไม่เปิดเผยชื่อผู้ถือหน่วยลงทุน (Omnibus Account) คือบัญชีซื้อขายหน่วยลงทุนในกองทุนรวม ชนิดไม่เปิดเผยชื่อผู้ถือหน่วยลงทุน ที่นักลงทุนเปิดเพียงบัญชีเดียวที่ธนาคาร ก็เหมือนได้ platform เปิดกว้างให้เราสามารถซื้อขายกองทุนจากหลากหลาย บลจ. ได้นั่นเอง สิ่งสำคัญที่ต้องพิจารณาก่อนเปิดบัญชีก็คือ ควรเลือกธนาคารพาณิชย์ขนาดใหญ่ที่มีความมั่นคง ฐานเงินทุนแข็งแกร่ง และมีการดำเนินงานที่เป็นมาตรฐานเชื่อถือได้ เพื่อให้เราสามารถลงทุนได้อย่างมั่นใจ

แล้ววันนี้...การซื้อกองทุนหลากหลายบลจ.จะไม่เป็นปัญหายุ่งยากอีกต่อไป ด้วยบัญชีซื้อขายหน่วยลงทุนแบบไม่เปิดเผยชื่อผู้ถือหน่วยลงทุน (Omnibus Account) จากธนาคารไทยพาณิชย์ เปิดประตูสู่โลกกว้างแห่งจักรวาลกองทุนรวม บนแอป SCB EASY

เพราะ “ลงทุนง่ายกับหลากหลาย บลจ.ชั้นนำผ่านแอป SCB Easy ที่เดียว”

นเหมือนใบเบิกทางในการเข้าถึงกองทุนรวมจากหลากหลายบริษัทหลักทรัพย์จัดการกองทุน (บลจ.) โดยไม่ต้องไปเปิดบัญชีเพิ่มเติมหลายๆ ที่ ไม่ต้องโหลดแอปหลายตัว ไม่ต้องกรอก ข้อมูลยืนยันตัวตนหลายครั้ง หรือผูกบัญชีหลายรอบ

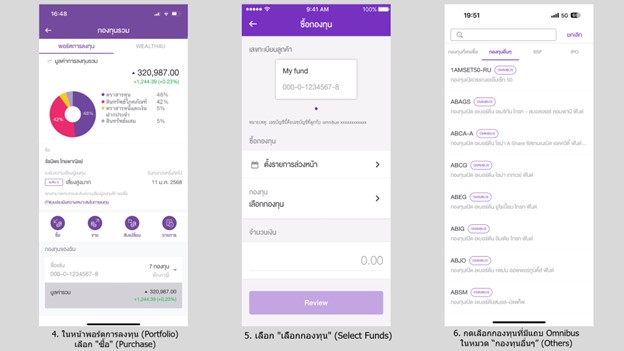

คัดสรรกองทุนเด่นจากหลากหลายบลจ. ทั้ง SCBAM และบลจ.ชั้นนำอื่นๆ โดยผู้เชี่ยวชาญการลงทุนของ SCB เลือกกองทุนพื้นฐานดี ผลการดำเนินงานเด่น ให้เลือกลงทุนเพื่อตอบโจทย์ทุกเป้าหมาย และสร้างโอกาสรับผลตอบแทน สามารถเปิดบัญชี และเริ่มลงทุนได้ด้วยตัวเองง่ายๆ ที่แอป SCB EASY

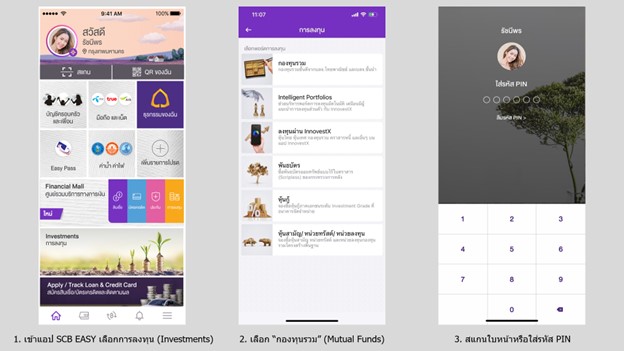

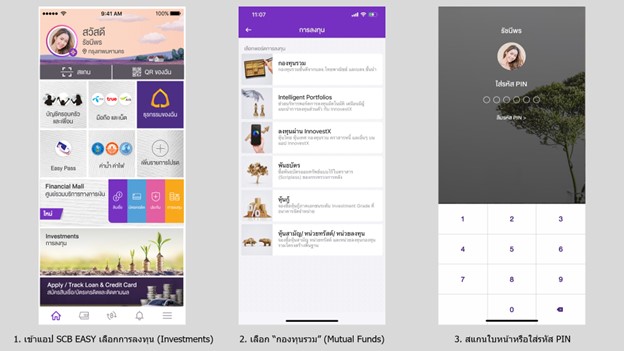

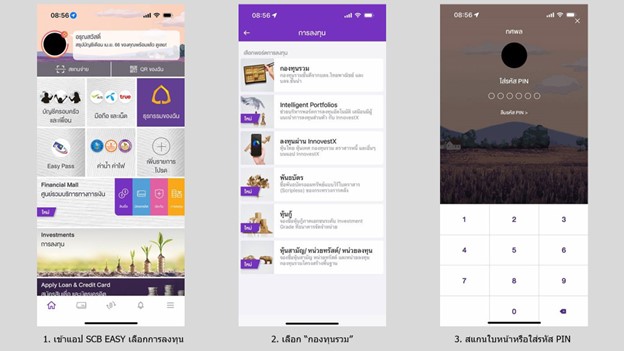

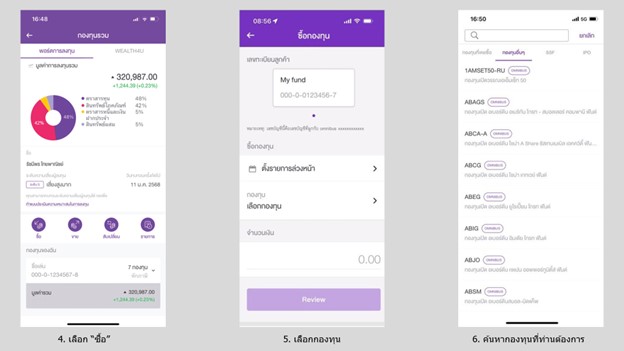

1. สำหรับลูกค้าใหม่ ที่ไม่เคยมีบัญชีกองทุนบนแอป SCB EASY

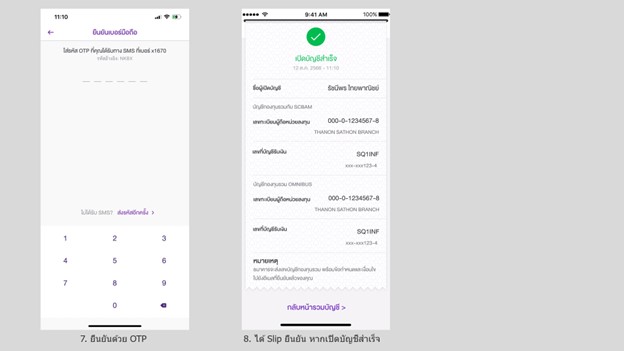

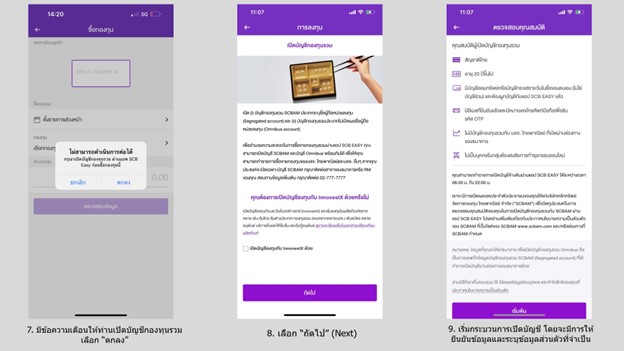

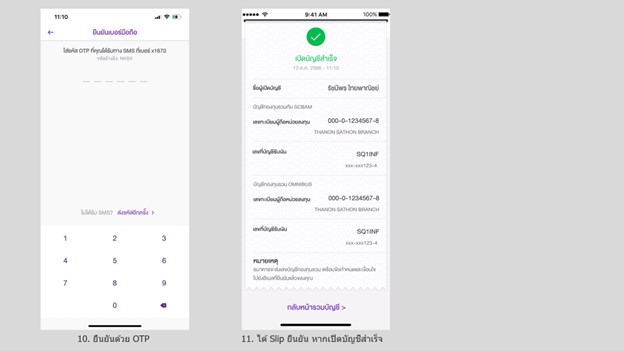

2. สำหรับลูกค้าที่มีบัญชีกองทุนบนแอป SCB EASY อยู่แล้ว และต้องการเปิดบัญชีซื้อขายหน่วยลงทุนแบบไม่เปิดเผยชื่อผู้ถือหน่วยลงทุน (Omnibus Account)

ผู้ลงทุนสามารถเลือกซื้อ/ขายกองทุนจากหลากหลายบลจ.ชั้นนำ ครบจบ ที่แอป SCB EASY ง่ายๆ ได้เอง

ใครที่สนใจลงทุนผ่านกองทุนรวม ไม่ว่าจะมือใหม่ หรือมีประสบการณ์แล้ว แนะนำให้เปิดบัญชีซื้อขายหน่วยลงทุนแบบไม่เปิดเผยชื่อผู้ถือหน่วยลงทุน (Omnibus Account) บนแอป SCB Easy ไว้เป็นทางเลือกที่ช่วยให้การลงทุนคล่องตัวขึ้น สะดวกสบายขึ้น โดยสามารถเปิดบัญชีได้แล้ววันนี้ ที่แอป SCB easy หรือ ที่ธนาคารไทยพาณิชย์ทุกสาขา ทั่วประเทศ

หมายเหตุ :

#บัญชีซื้อขายกองทุนบลจ.อื่น #OmnibusAccount #นิ้วโป้ง

#SCBX #SCBWealth #SCBEASY