I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- A will, an important matter that should not be overlooked in an age of uncertainty

- Personal Banking

- ...

- A will, an important matter that should not be overlooked in an age of uncertainty

STORIES & TIPS

A will, an important matter that should not be overlooked in an age of uncertainty

A will, an important matter that should not be overlooked in an age of uncertainty

In today's era where there are more epidemics and diseases. Making a will is recognized by the administration and passing on the family's wealth as an important matter. And it is something that should not be thought of doing at old age to reduce various problems. that may occur if something unexpected happens. For example, death before a will is made. Being sick to the point that he cannot make a will, therefore making a will is something that should be considered and prepared immediately for those who want to pass on their inheritance to future generations.

What does the word 'will' mean? A will is a letter that shows the will of a departing person about how they want their estate to be passed on if they have passed away. go with the property to pass on to the legatee or statutory heir

Dr.Satit Phongphanya SVP Estate Planning And Family Office SCB

Many of you may have a question in your mind whether we can write a will or not? We can see that at present there is information about making a will. Including many testament examples on the Internet for us to study. which if we are confident that such information can be used to make a will correctly in accordance with the form required by law We may also be able to write our own wills.

In case we want to make a will ourselves The first point we should understand is that wills can only be managed by one's own property. Therefore, we must know before making a will that we have exactly how much property we have. The word how much may not be necessary to know in detail how much money there is. But we should know what assets we have. Is the existing property a marital property?

As in the case of a legally registered couple have lived together for a long time All assets that are jointly acquired and acquired are marital assets. In which the property of marriage means all property acquired during the marriage. and arising from a joint livelihood after marriage In which the husband is the owner of 30 units of property, 70 units are in the wife's name. When the husband will make a will, he may understand that the property that can be passed on to his will is only 30 units, which is not correct. because really Then the property of the deceased must be calculated from the common marital property. by having to divide the marital property in half to get it right first In this case, each person will be able to divide 50 units, so in this case the husband will make a will to pass on his property for 50 units.

Second point We can determine in our wills who will be our wills. Including being able to determine the proportion of assets for the legatee in which the testator can be anyone You don't have to be in the same family.

But anyway if we are not very sure about making a will and would like to have a strategy for making a will that is suitable for the transfer of assets Hiring a specialist, a lawyer, is another popular option that many people do.

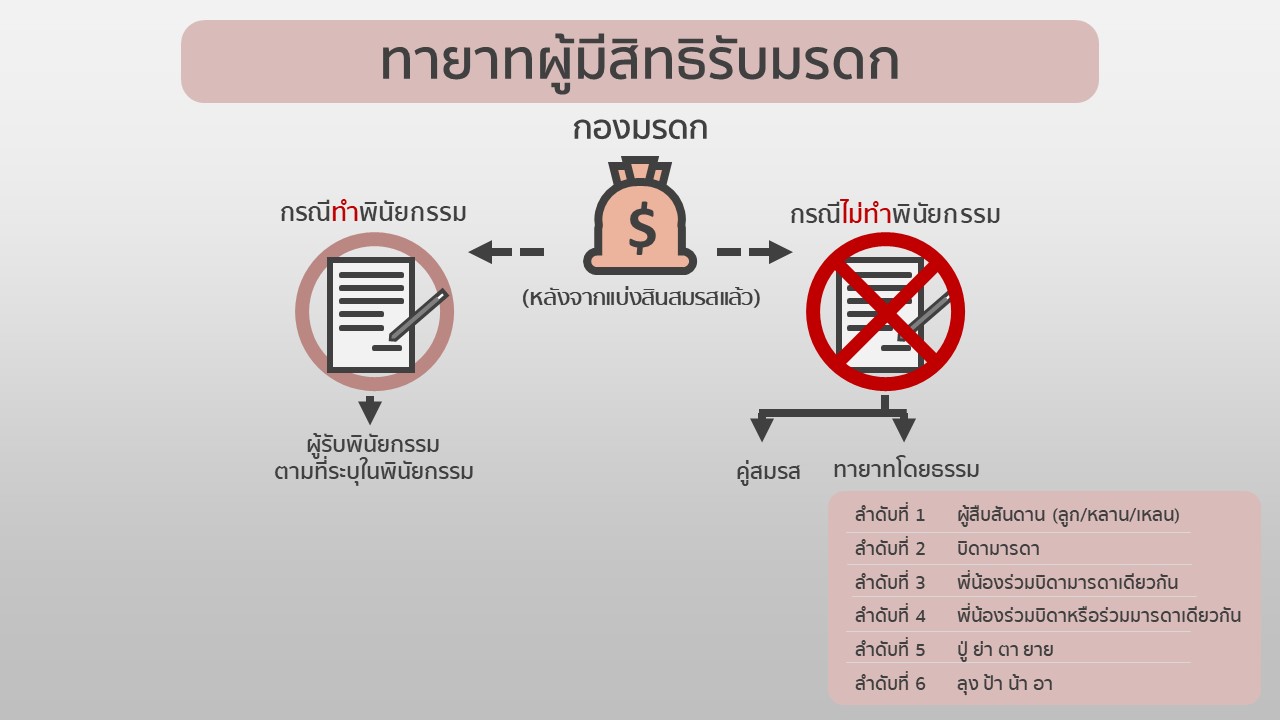

For those who still hesitate Not sure if you should make a good will or not? In this case, we should have an understanding that If we do not make a will, our property will pass to the statutory heirs. Which Thai law will determine who is the statutory heir They are divided into 2 groups as shown in the picture below.

Group 1, we call 6 heirs, while Group 2 is spouse.

If the deceased has statutory heirs of every order Those who are eligible for inheritance are not of all ranks. Because the law stipulates that the statutory heirs in the previous order will cut off the rights of the latter statutory heirs. The only exception in which there is no cutoff is that the 1st and 2nd ranks are entitled to inherit at the same time. In which the legally registered spouse is regarded as a statutory heir as a special case. Which will receive the inheritance together with the heirs of various order according to the proportion prescribed by law

for example In the event that the deceased has 50 units of property, there is a surviving spouse with 2 children, their parents are still alive. In this case, there will be 2 heirs in the first order. Parents are the heirs in the 2nd order, there will also be 2 persons. The parents of the deceased will also be divided equally as the children. Therefore, all 5 people will receive an equal share. Therefore, each person will receive 10 units each, which is divided according to the assumption of the law.

Therefore, have you seen that wills are important? If we can write correctly or if there is an expert to help write Passing on our inheritance will be exactly the same as the intent. And reduce the burden of having children sit and talk or make an agreement among themselves. because the will is the true intention of the owner of the property. Everyone will respect this will. So I invite you to come and make a will. In order to make that wealth pass on to the children correctly, appropriately, fairly and reduce the quarrels of each family.

#SCBPrivateBanking #SCBWealth #FamilyWealthPlanning #SCBFamilyOffice

Dr. Satit Phongthanya

Senior Vice President, Estate Planning And Family Office, Siam Commercial Bank

Inform 17 May 2023

source : The Standard Wealth