I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Deposits

- Foreign Currency Deposit Account

- Electronic Foreign Currency Deposit Account (e-FCD)

- Personal Banking

- ...

- Electronic Foreign Currency Deposit Account (e-FCD)

Electronic Foreign Currency Deposit Account (e-FCD)

Enjoy a special interest rate of up to 2.5% p.a.*, Start saving USD on the SCB EASY App!

You can now trade gold with e-FCD accounts!

Trade 99.99% gold in USD on Hua Seng Heng’s USD GOLD TRADE App.

Seize great interest rates now!

e-FCD account (Electronic Foreign Currency Deposit)

Save in USD and earn up to 2.5% p.a.* special interest!

Deposit in 5 major currencies: USD, GBP, EUR, SGD, and CNY.

Key benefits of e-FCD account (Electronic Foreign Currency Deposit)

Earn up to 2.5% p.a.* special interest!

Special! No account maintenance fees.** Open an account with no minimum deposit and no fixed deposit required.

Enjoy the best rates,

save instantly.

Excahge 5 foreign currencies with exclusive rates.

Convenient & easy-all

in one app.

Open an account and manage foreign currency transactions anywhere via the SCB EASY App.

Maximize investments,

seize more profits.

Invest in global mutual funds and trade, save, or purchase gold with Hua Seng Heng.

How to open the account

Easily open e-FCD Account (Electronic Foreign Currency Deposit) via the SCB EASY App.

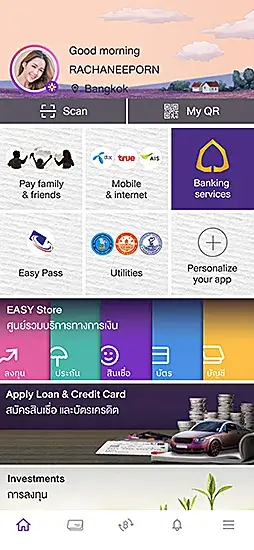

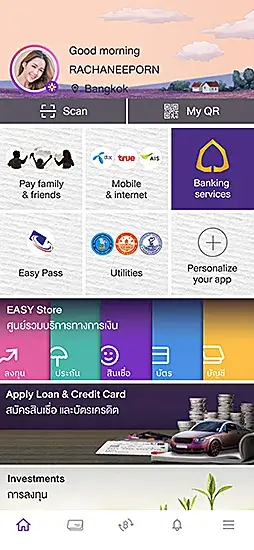

1. Select “Banking Services”

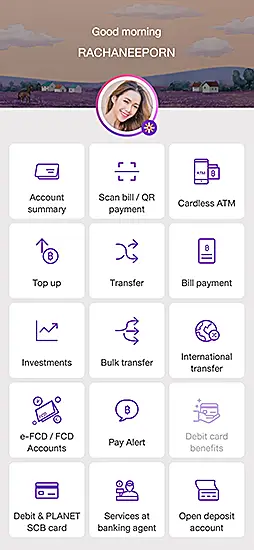

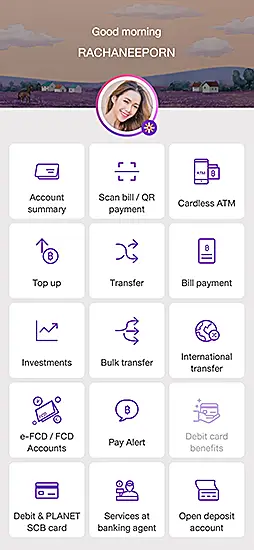

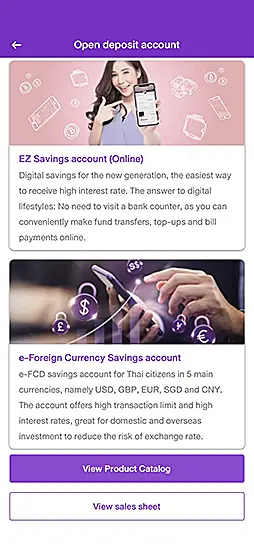

2. Select “Open Deposit Account”

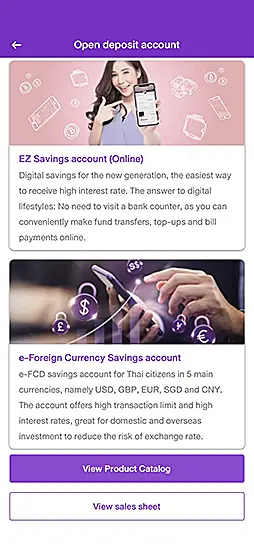

3. Select “Open e-FCD Account”

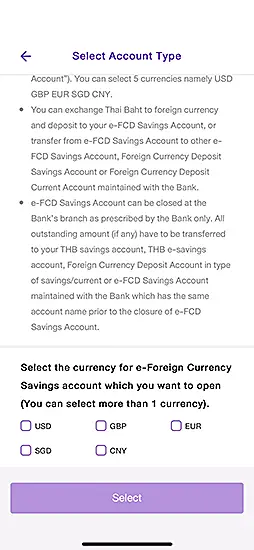

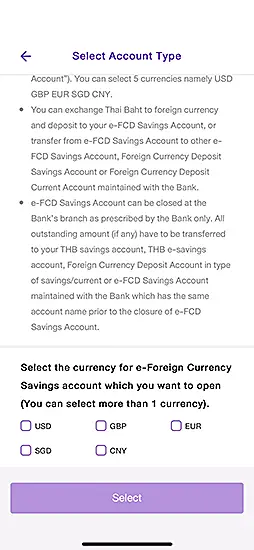

4. Select the currency (or currencies) for your account.

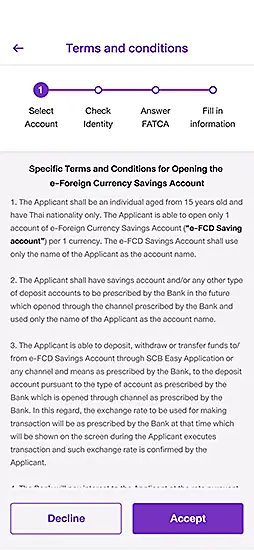

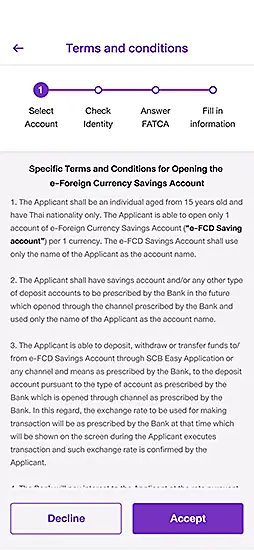

5. Read “Terms and Conditions” and tap “Accept”

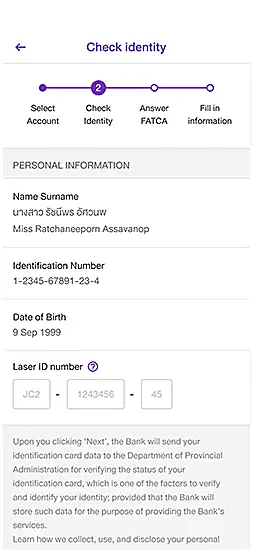

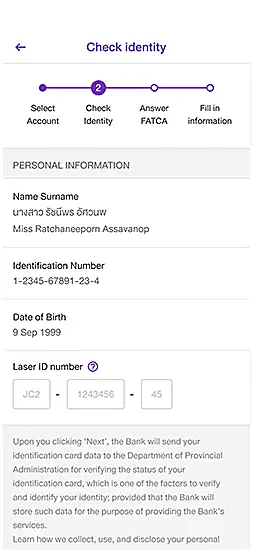

6. Enter the “Laser ID Number” and click “Next” to verify your identity

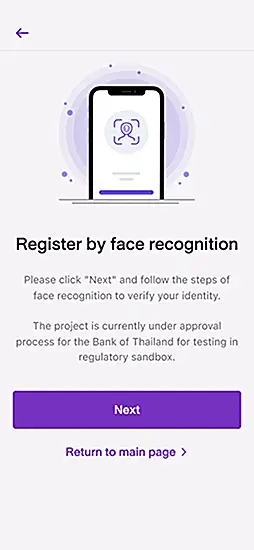

7. Press “Next” to verify your identity using a face scan.

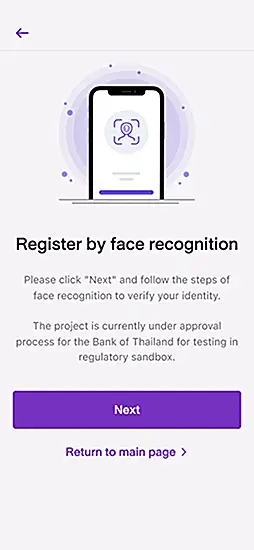

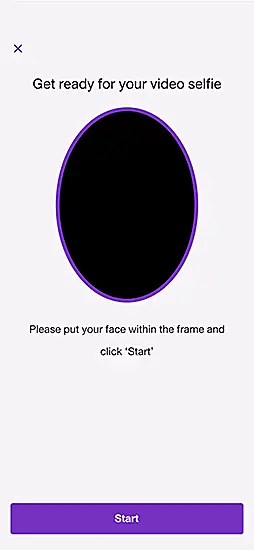

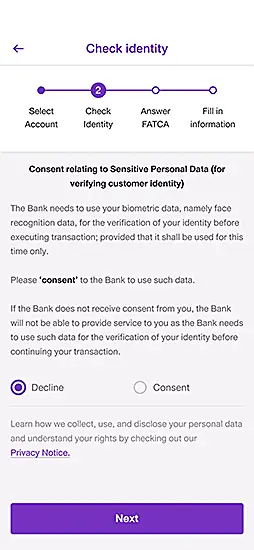

8. Provide “Consent Relating to Sensitive Personal Data”

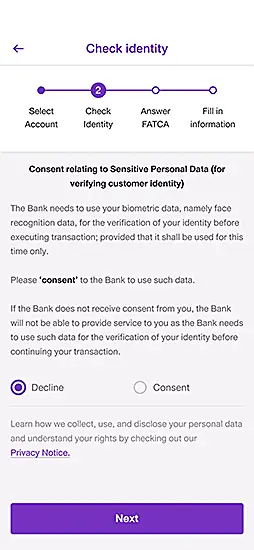

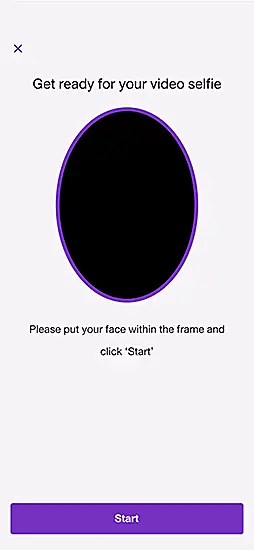

9. Proceed with a face scan to continue to the next step

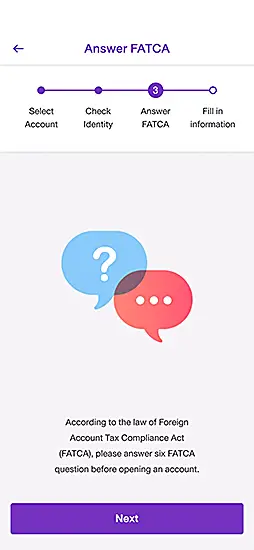

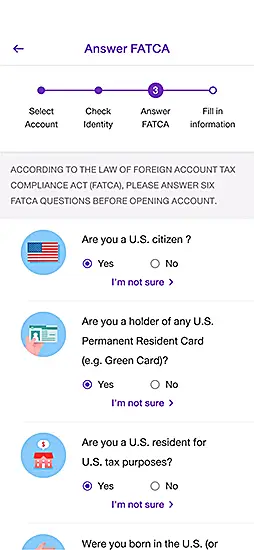

10. Tap “Next” to answer “FATCA Questions”

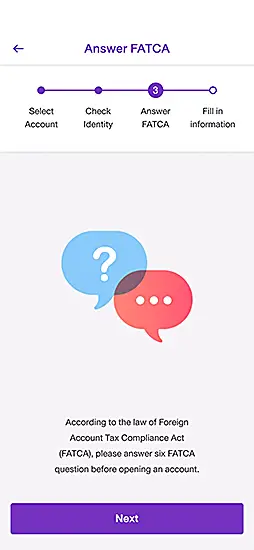

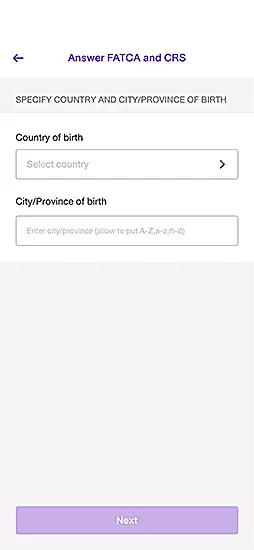

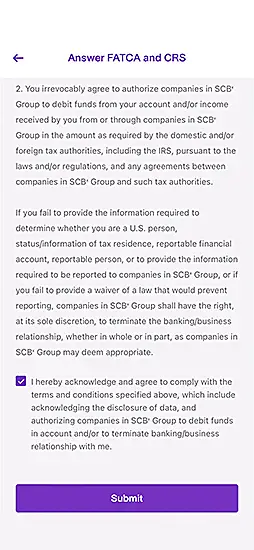

11. Answer “FATCA and CRS Questions”

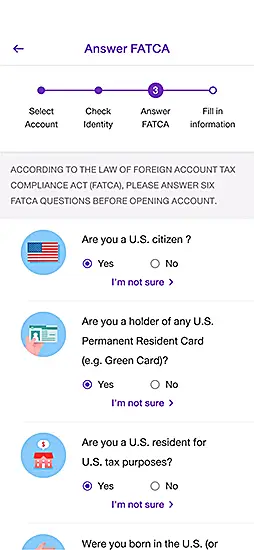

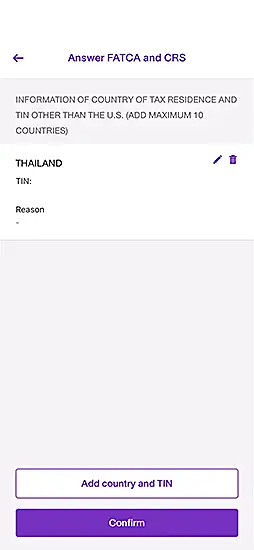

12. Review your “Taxpayer ID” and tap “Confirm”.

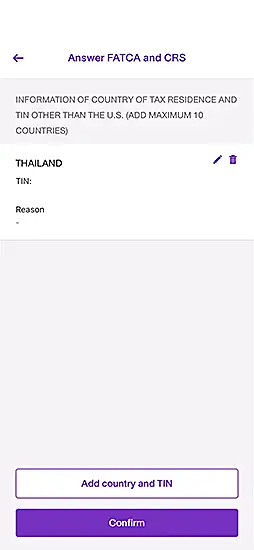

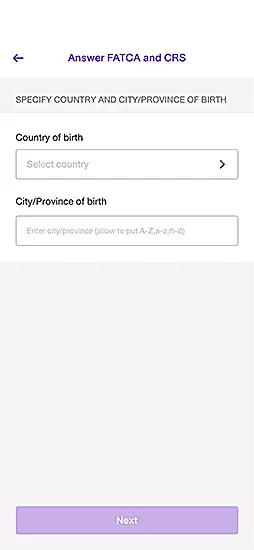

13. Enter your “Country of Birth and City/Province of Birth”, then tap “Confirm”.

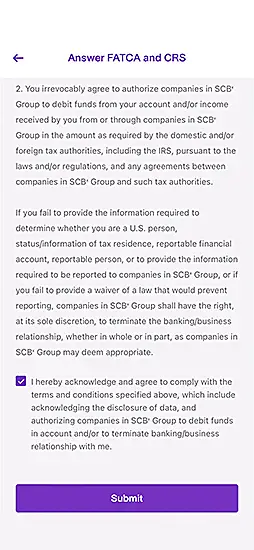

14. Read and accept “Terms and Conditions”, then tap “Confirm”.

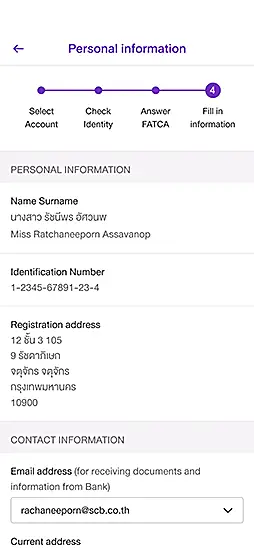

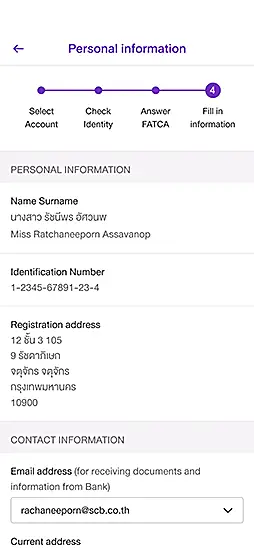

15. Fill and review “Your Personal Information” and tap confirm

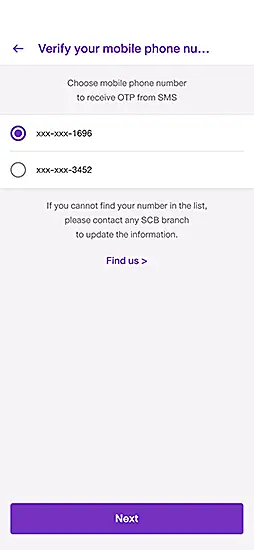

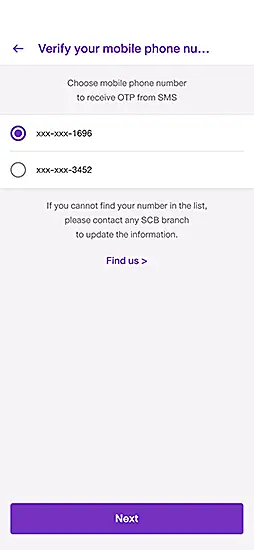

16. Select your “Phone Number” for OTP verification and enter the received OTP.

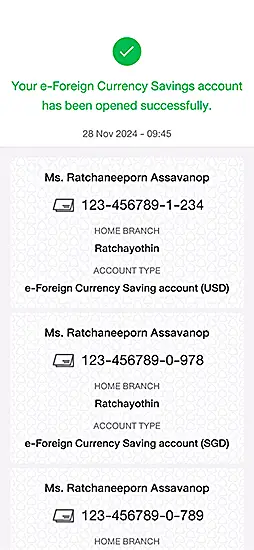

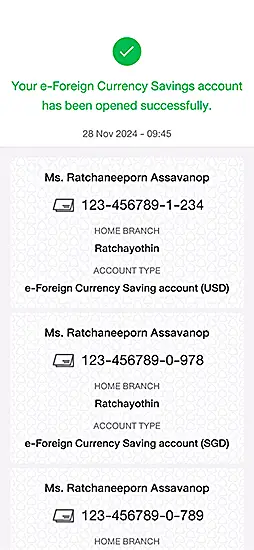

17. Your e-FCD account opening is successful. Tap “Return” to the Account Home Screen.

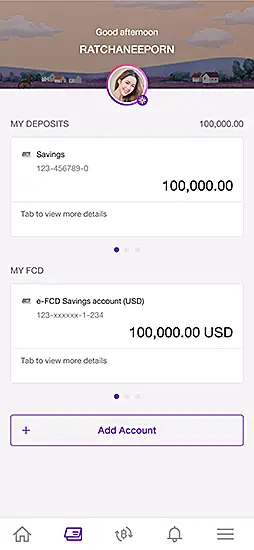

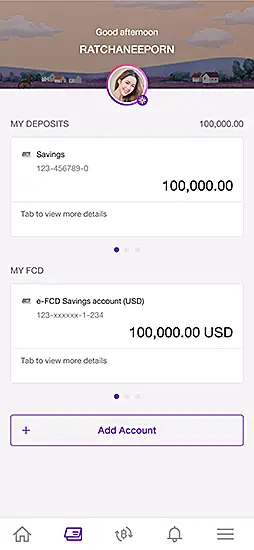

18. The e-FCD account will be automatically added to the Account Home Screen.

1. Select “Banking Services”

2. Select “Open Deposit Account”

3. Select “Open e-FCD Account”

4. Select the currency (or currencies) for your account.

5. Read “Terms and Conditions” and tap “Accept”

6. Enter the “Laser ID Number” and click “Next” to verify your identity

7. Press “Next” to verify your identity using a face scan.

8. Provide “Consent Relating to Sensitive Personal Data”

9. Proceed with a face scan to continue to the next step

10. Tap “Next” to answer “FATCA Questions”

11. Answer “FATCA and CRS Questions”

12. Review your “Taxpayer ID” and tap “Confirm”.

13. Enter your “Country of Birth and City/Province of Birth”, then tap “Confirm”.

14. Read and accept “Terms and Conditions”, then tap “Confirm”.

15. Fill and review “Your Personal Information” and tap confirm

16. Select your “Phone Number” for OTP verification and enter the received OTP.

17. Your e-FCD account opening is successful. Tap “Return” to the Account Home Screen.

18. The e-FCD account will be automatically added to the Account Home Screen.

e-FCD Account Details

- Service Type: Electronic Foreign Currency Deposit (e-FCD) Savings Account.

- Earn up to 2.5% p.a.* interest in USD, exclusively from April 1 to June 30, 2025.

- Accepted Currencies: US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Singapore Dollar (SGD), and Yuan (CNY).

- How to Open: Open an account and manage transactions conveniently via the SCB EASY App.

- Special Offer: Enjoy zero e-FCD account maintenance fees from February 28 to December 31, 2025.

| Currencies | Special Interest Rate* (April 1 - June 30, 2025) |

|---|---|

| USD | 2.50% |

| GBP | 0.20% |

| EUR | 0.00% |

| CNY | 0.35% |

| SGD | 0.00% |

Know Before You Save! e-FCD accounts are subject to foreign exchange rate risk.

Notes:

- *Enjoy a special USD deposit interest rate of up to 2.5% p.a. from April 1 to June 30, 2025. From July 1, 2025, the standard rate of 0.15% p.a. applies.

- Interest rates for GBP, EUR, SGD, and CNY vary by currency. Please visit the bank's website for details.

- **Special promotion: e-FCD account maintenance fees waived from February 28 to December 31, 2025, and starting January 1, 2026, e-FCD account maintenance fees will be charged to each currency as follows

- USD: Minimum deposit of USD 250 per month is required. If the minimum deposit is lower than the specified amount, there will be a maintenance fee of USD 10 per month.

- GBP: Minimum deposit of GBP 200 per month is required. If the minimum deposit is lower than the specified amount, there will be a maintenance fee of GBP 8 per month.

- EUR: Minimum deposit of EUR 200 per month is required. If the minimum deposit is lower than the specified amount, there will be a maintenance fee of EUR 8 per month.

- SGD: Minimum deposit of SGD 300 per month is required. If the minimum deposit is lower than the specified amount, there will be a maintenance fee of SGD 10 per month.

- CNY: Minimum deposit of CNY 1,500 per month is required. If the minimum deposit is lower than the specified amount, there will be a maintenance fee of CNY 70 per month. The bank reserves the right to adjust deposit interest rates and terms as per its announcements.

- Deposits and withdrawals in e-FCD accounts are subject to foreign exchange rate risks. Customers are advised to carefully review the product details and terms before making a decision.

- e-FCD accounts must adhere to the criteria established by the Bank of Thailand.

Product Information

Interest Rates, Exchange Rates, and Fees

Solutions for partners

Smart savings with e-FCD

Payment