I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Other Services

- International money transfer

- International money transfers via the PromptPay International

- Personal Banking

- ...

- International money transfers via the PromptPay International

International money transfers via the PromptPay International

International money transfers via the PromptPay International on SCB EASY App

Service Details

International money transfers via the PromptPay system or PromptPay International are designed to accommodate retail customers seeking to send and receive cross-border remittances conveniently, quickly, and safely, using just a PromptPay account registered with a mobile phone number. Currently, PromptPay International is available between Thailand and Singapore’s PayNow. To make fund transfers even easier, customers just need to follow these simple steps:

- Outward remittance via PromptPay International: Senders can initiate a transaction via the SCB Easy App by specifying a receiver’s mobile phone number. After the sender has verified and confirmed the name of the receiver and the transaction, SCB will send a payment instruction to the destination bank and send notification of the transfer to the sender.

- Inward remittance via PromptPay International:SCB will send a payment notification to the beneficiary when receiving a transfer from abroad to the PromptPay account registered with a mobile phone number. The beneficiary can check the incoming amount from the payment notification or SCB Easy App.

More convenient, quicker, and cheaper when transferring money overseas via the SCB Easy App.

More convenient

Available instantly as soon as the application is downloaded. Customers can perform transactions anywhere, 24 hours a day 7 days a week, without having to visit a bank branch. Simply enter a telephone number registered with the destination payment system and no more paperwork is needed. A notification will be sent when the money reaches the beneficiary.

Quicker

The PromptPay system provides a direct connection with a payment system abroad, allowing the money to reach the beneficiary immediately as soon as the transaction is completed.

Cheaper

The beneficiary gets the full transfer amount without fee deduction. The sender pays a fee of only 150 baht.

Other information

- Eligible for savings accounts opened by individuals

- Services available 24 hours a day, 7 days a week

- Transfers made in real-time

- Money credited instantly after a transaction is completed

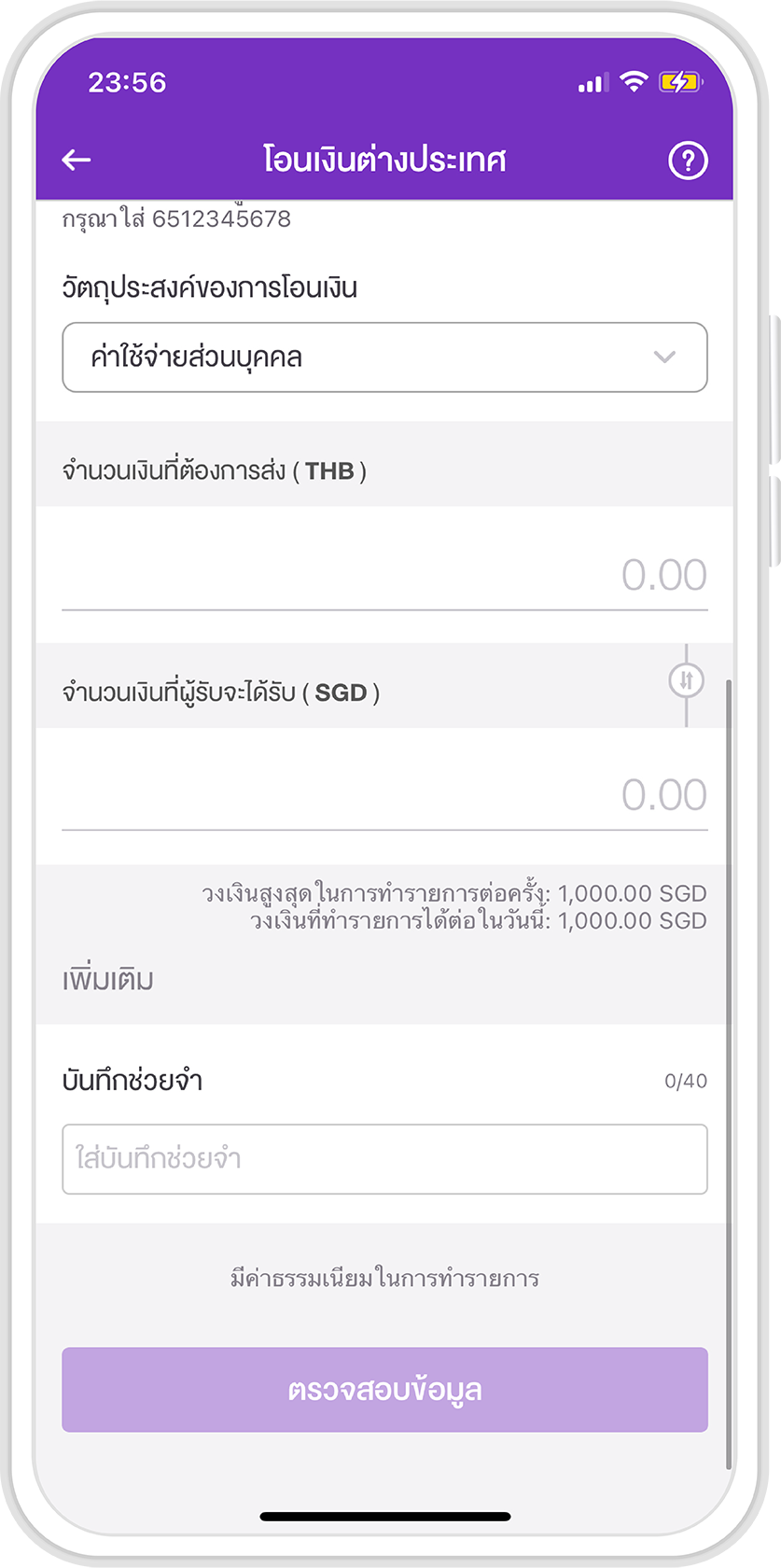

- Maximum limit of SGD 1,000 per time and per day

- No need to apply in advance or provide any document

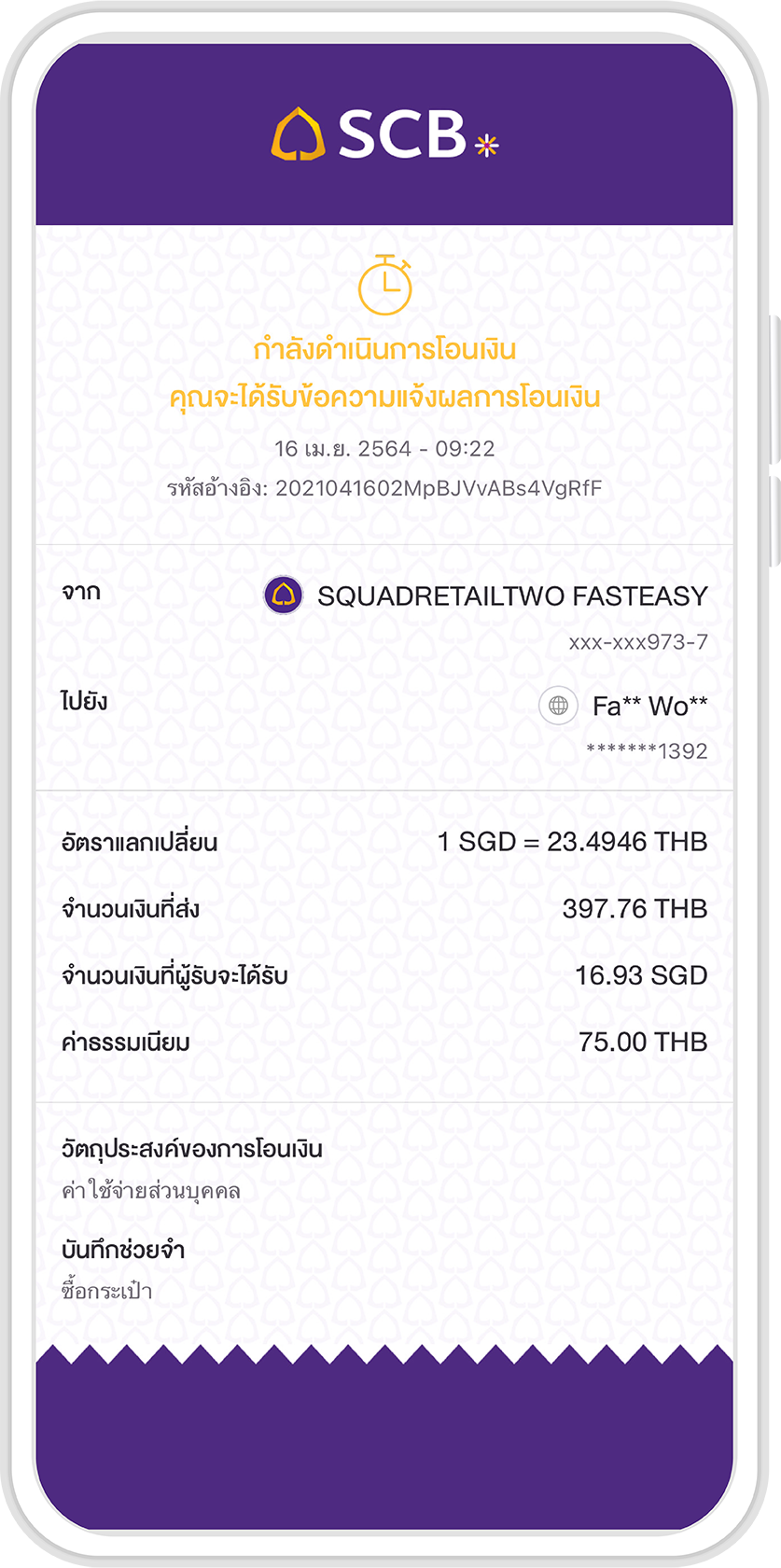

- An e-slip is available for every transaction automatically saved to a mobile phone and can be shared via any messaging application as evidence for the beneficiary.

- As the funds transfer evidence (slip) is not the evidence stating that the funds have already been transferred into the recipient’s deposit account, therefore, the recipient needs to check by itself that the funds have already been transferred into the recipient’s deposit account to confirm that the funds transfer transaction is successful.

Special offers when transferring with the SCB EASY App

- A transfer fee of only 150 baht per transaction

- Receive transfers quickly in the full amount

- Notification available in the application instantly when the transfer reaches the beneficiary.

- An official e-mail notification when the transfer is successful.

Transaction Process

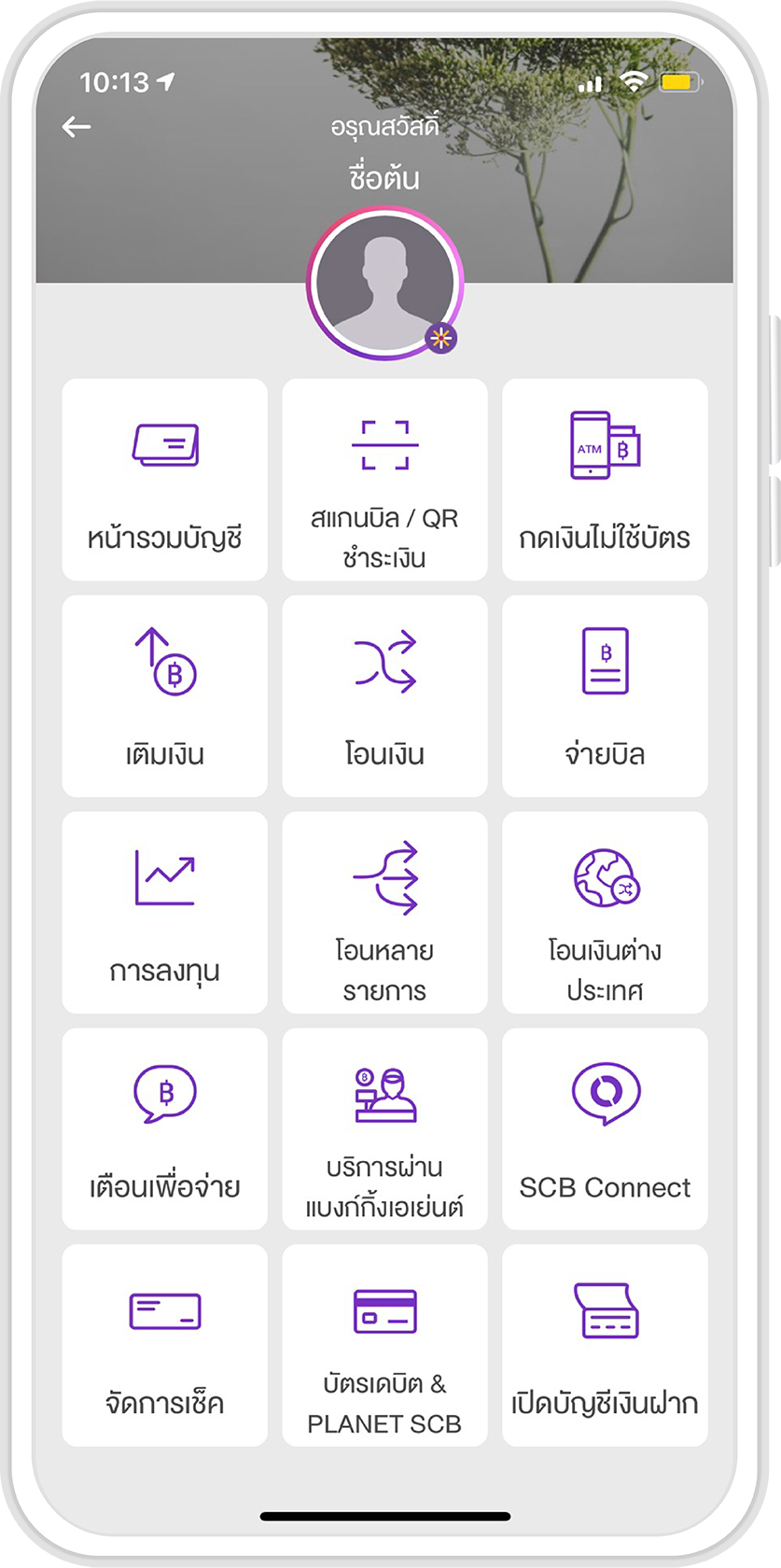

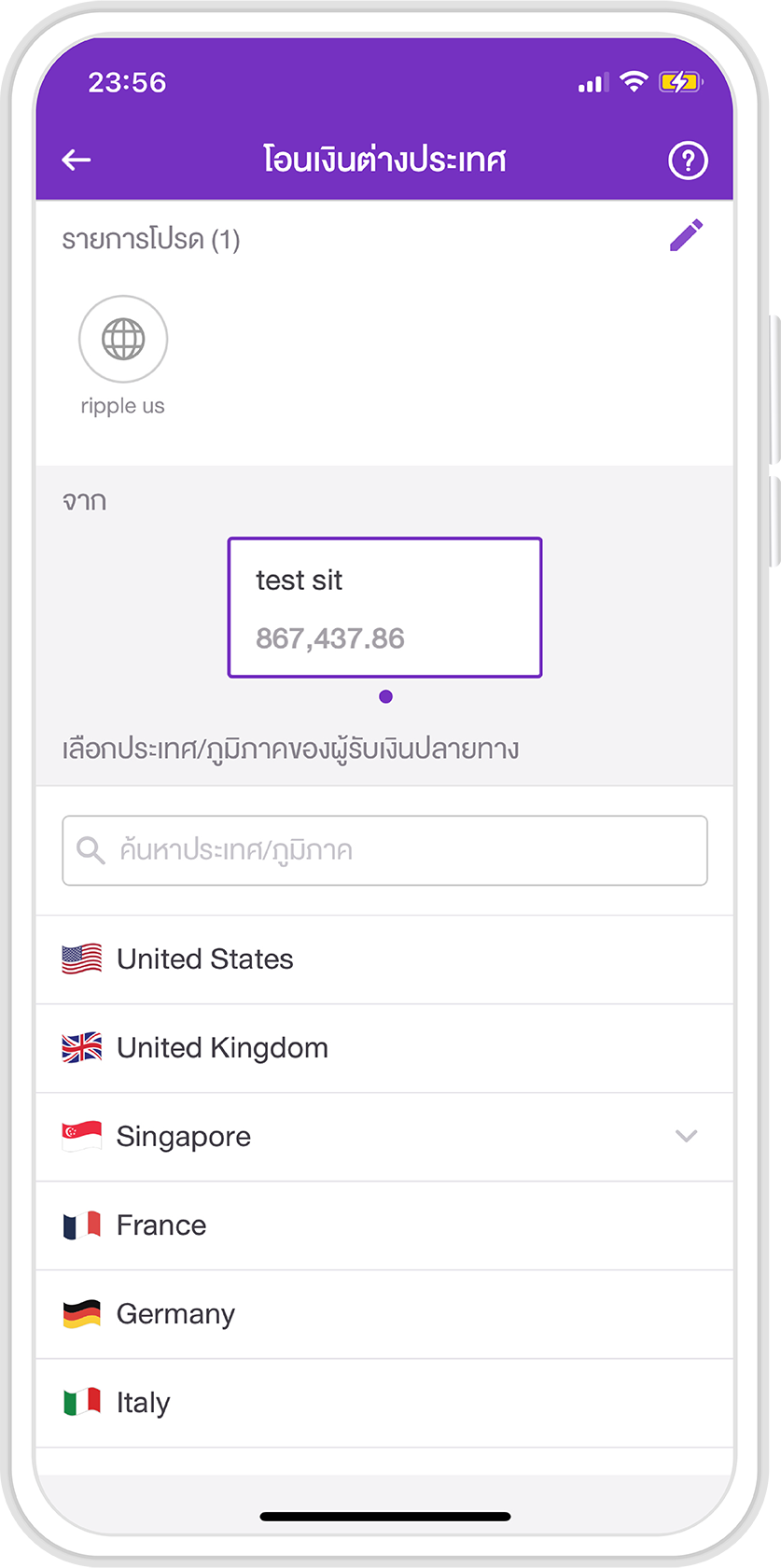

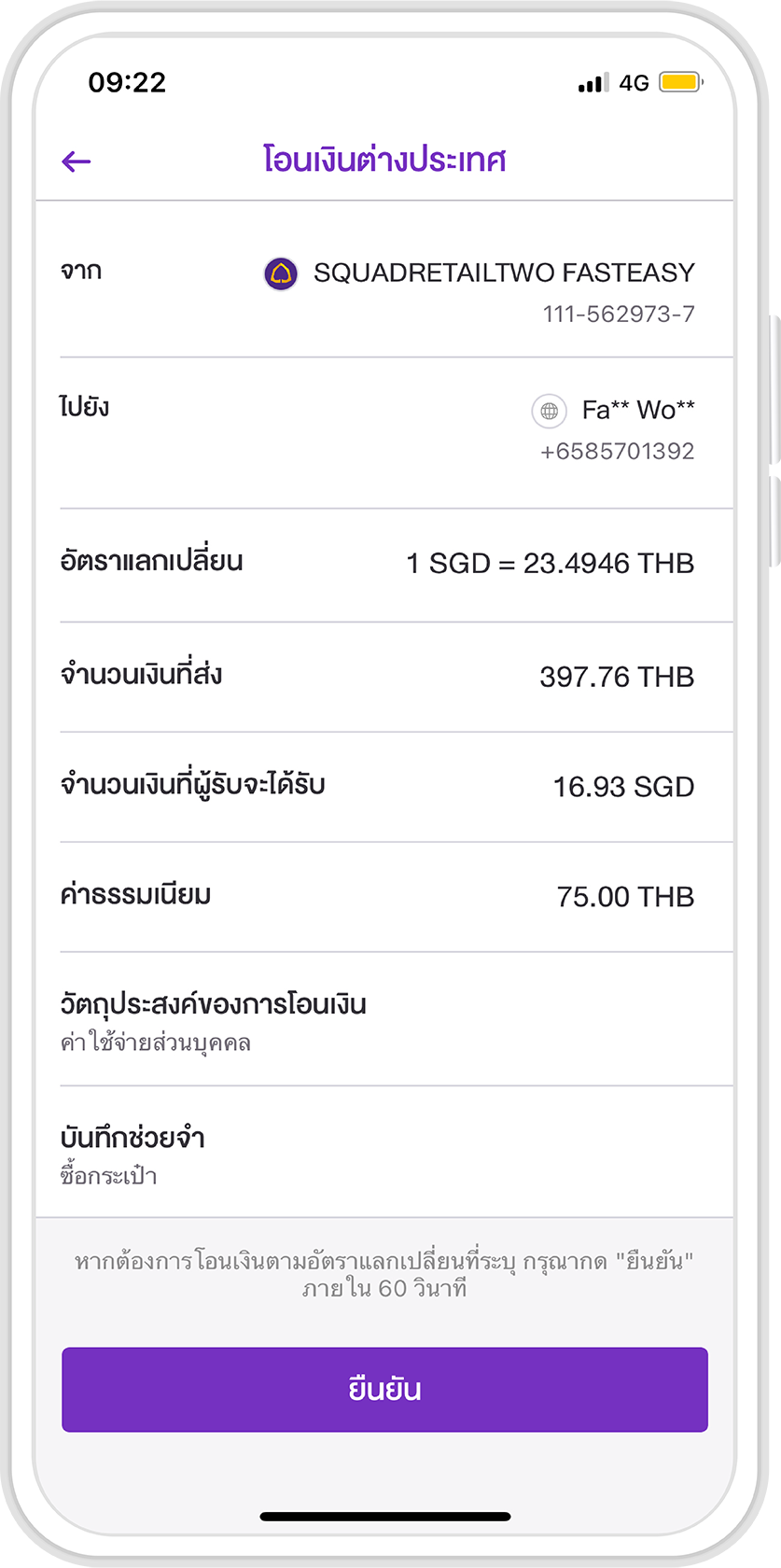

1. Log in to the SCB Easy app and choose “Banking Services”. Choose “International Transfer”.

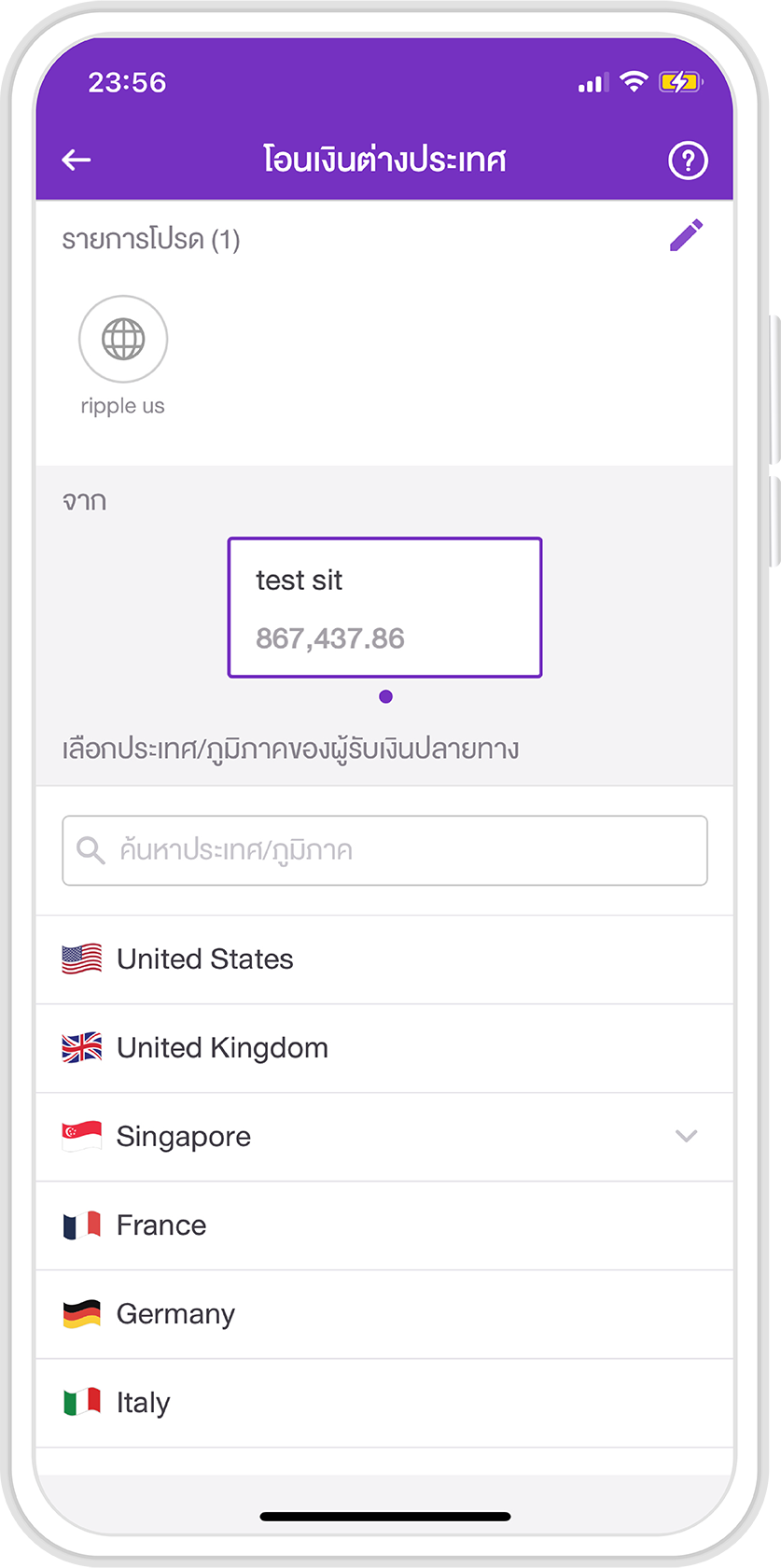

2. Choose the “Account”.

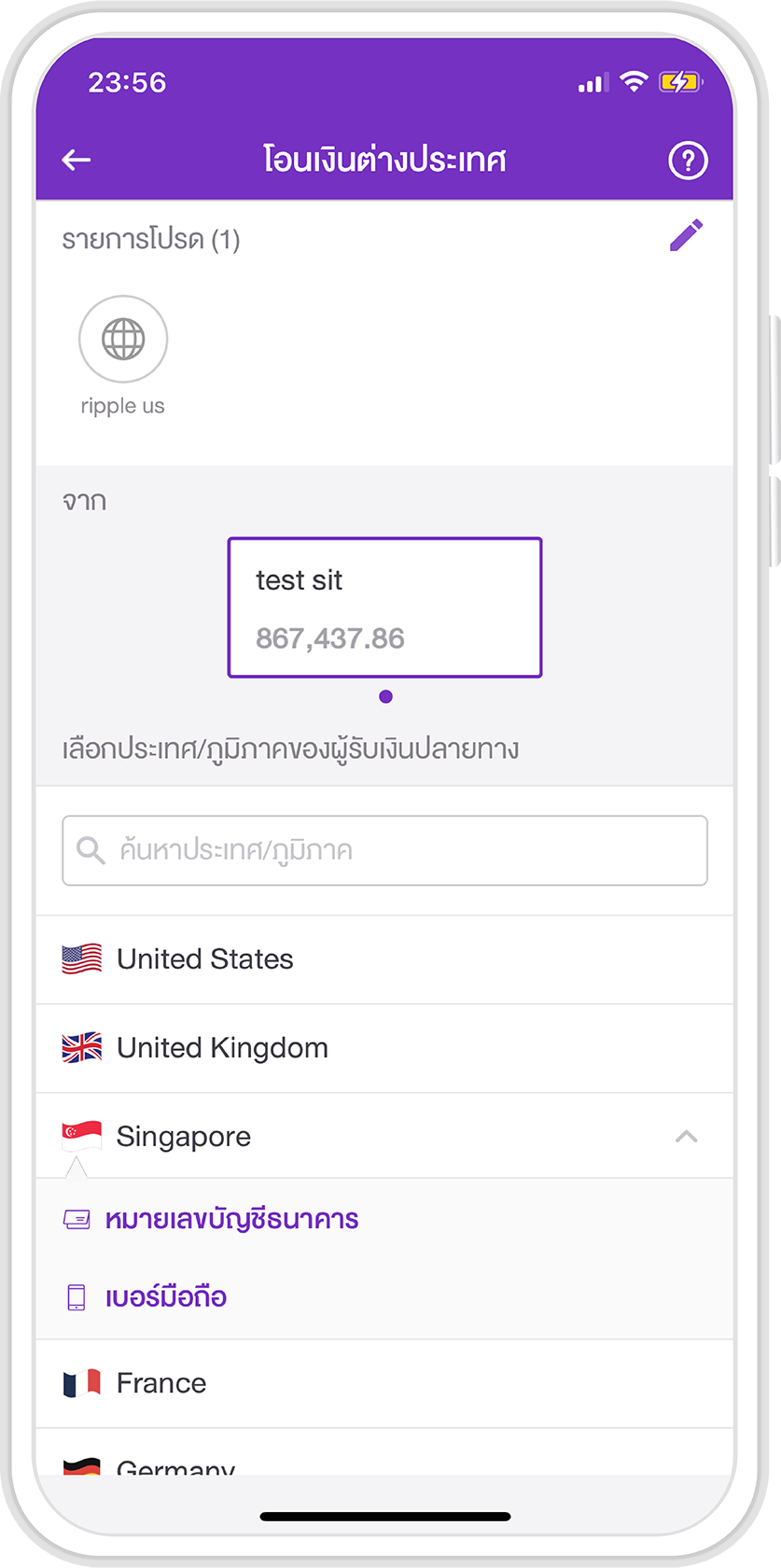

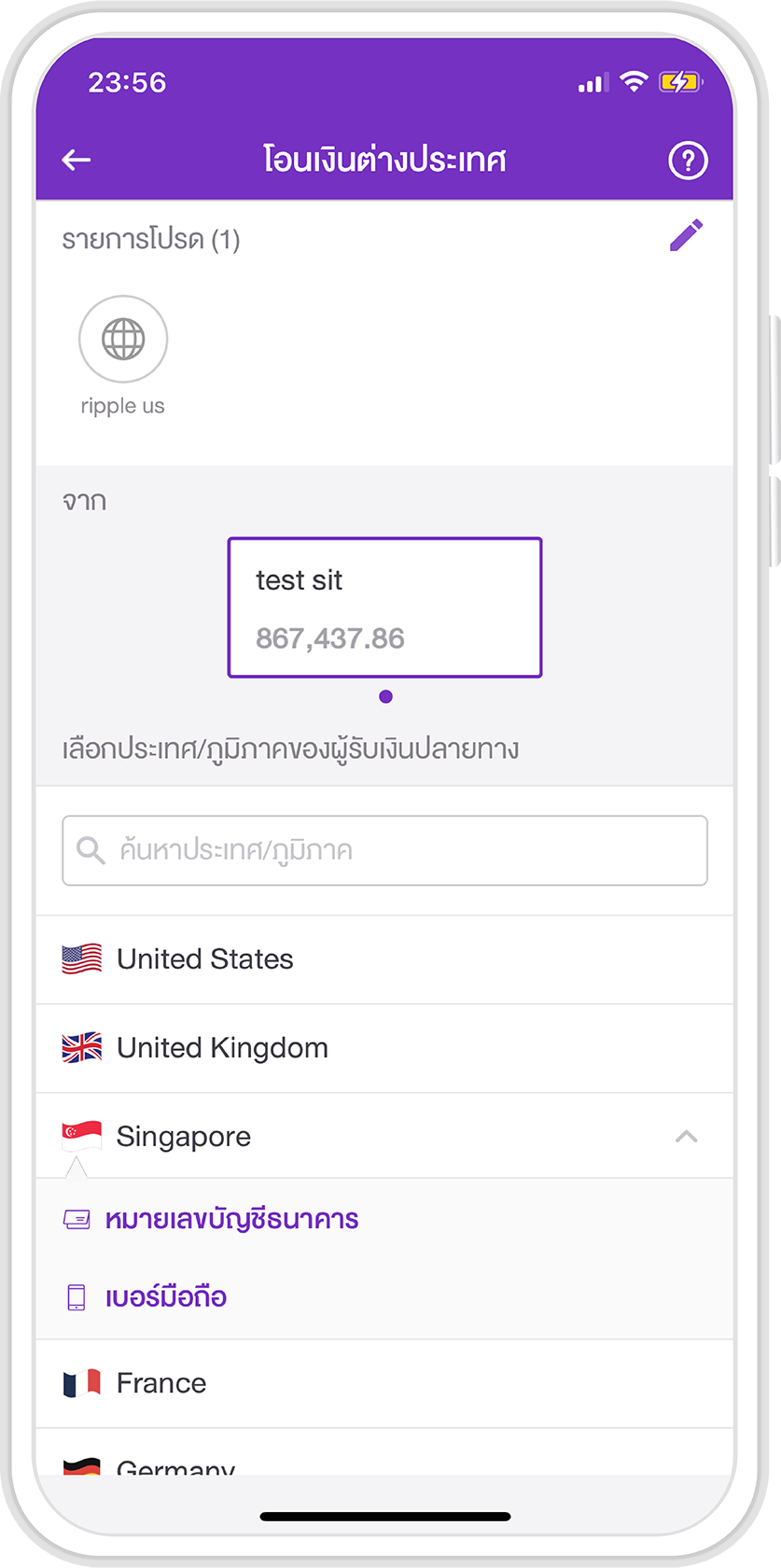

3. Choose “Singapore”.

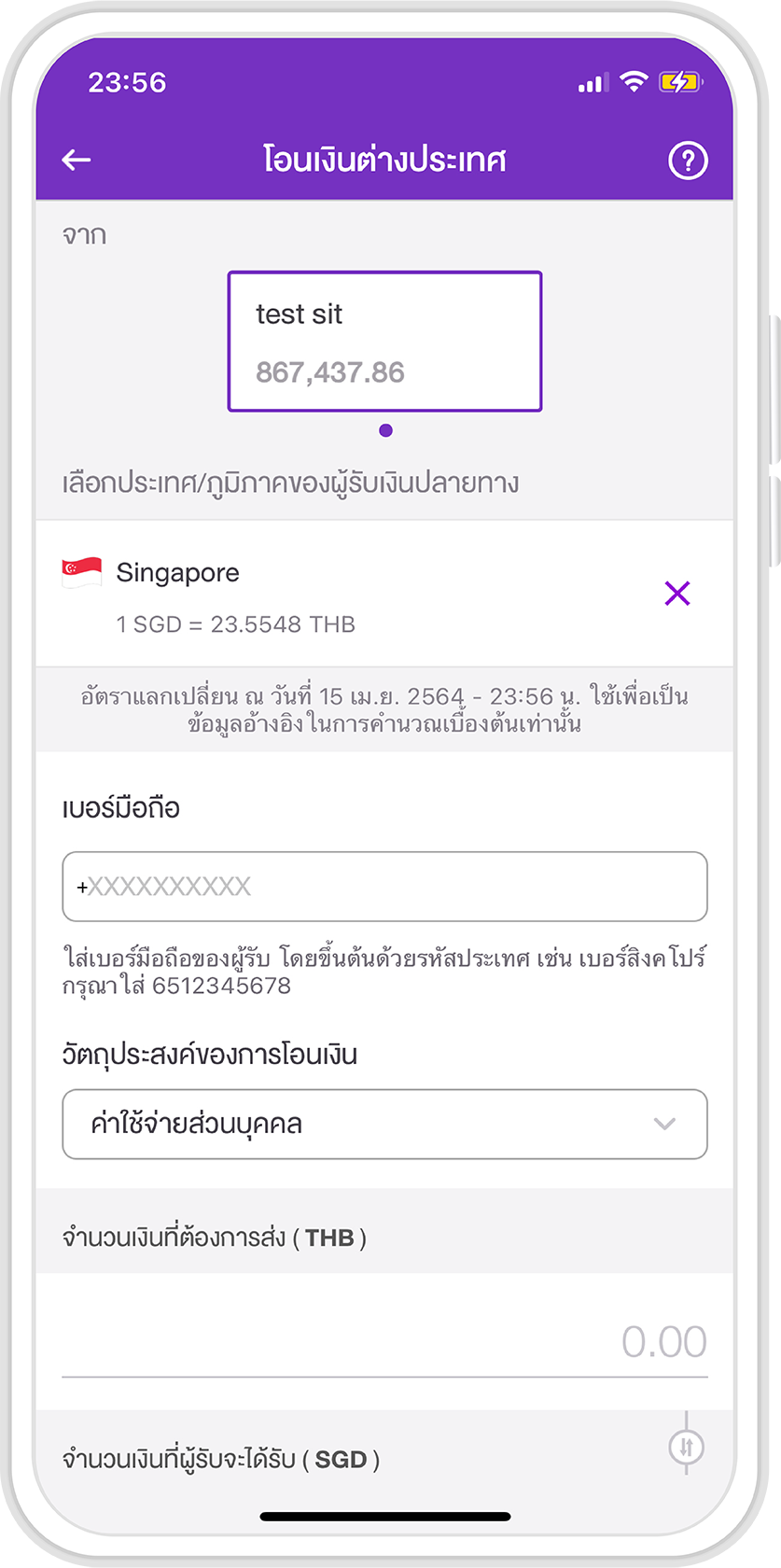

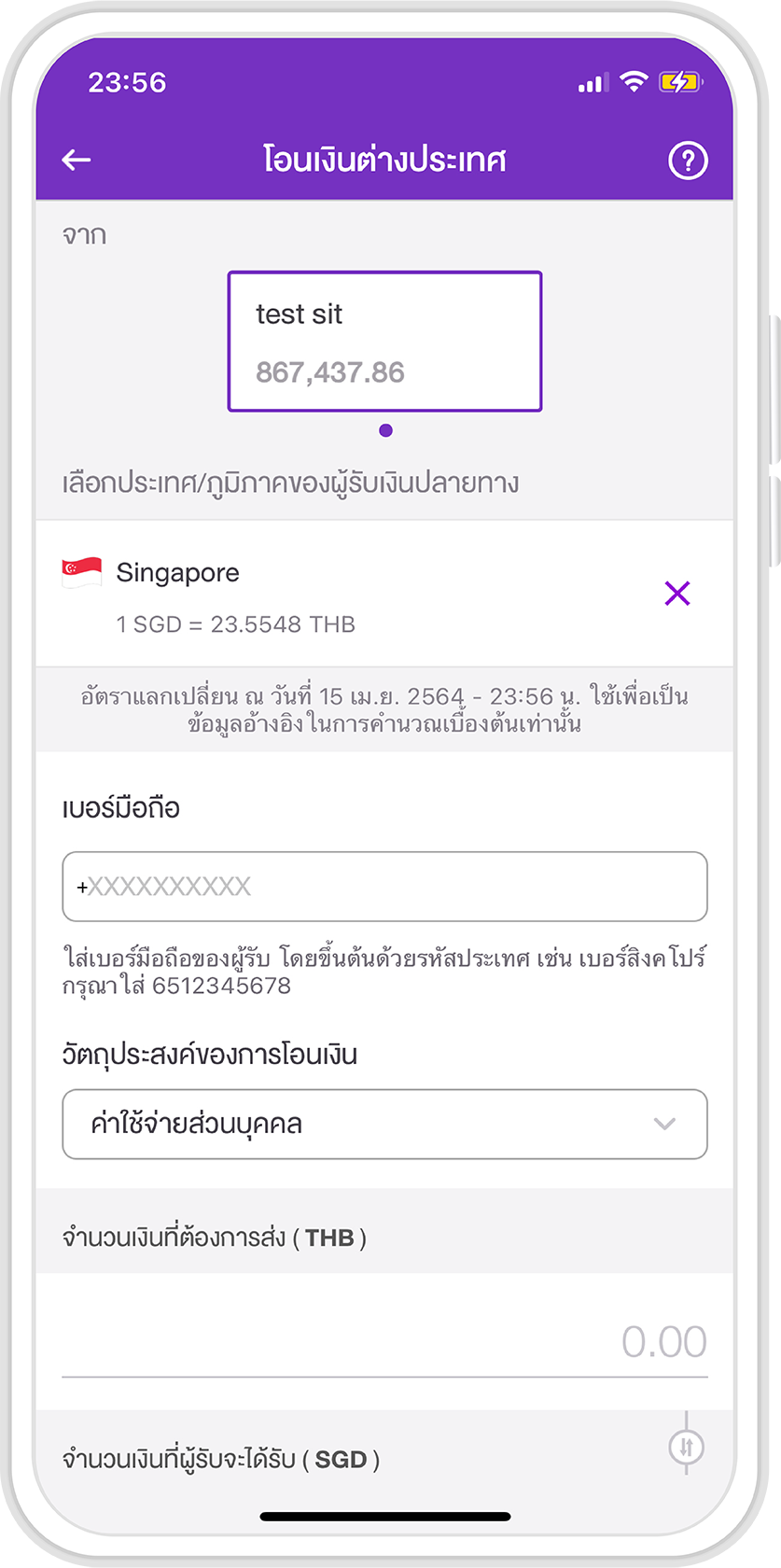

4. Choose the “Mobile Number”. Enter the “Mobile number” of the beneficiary.

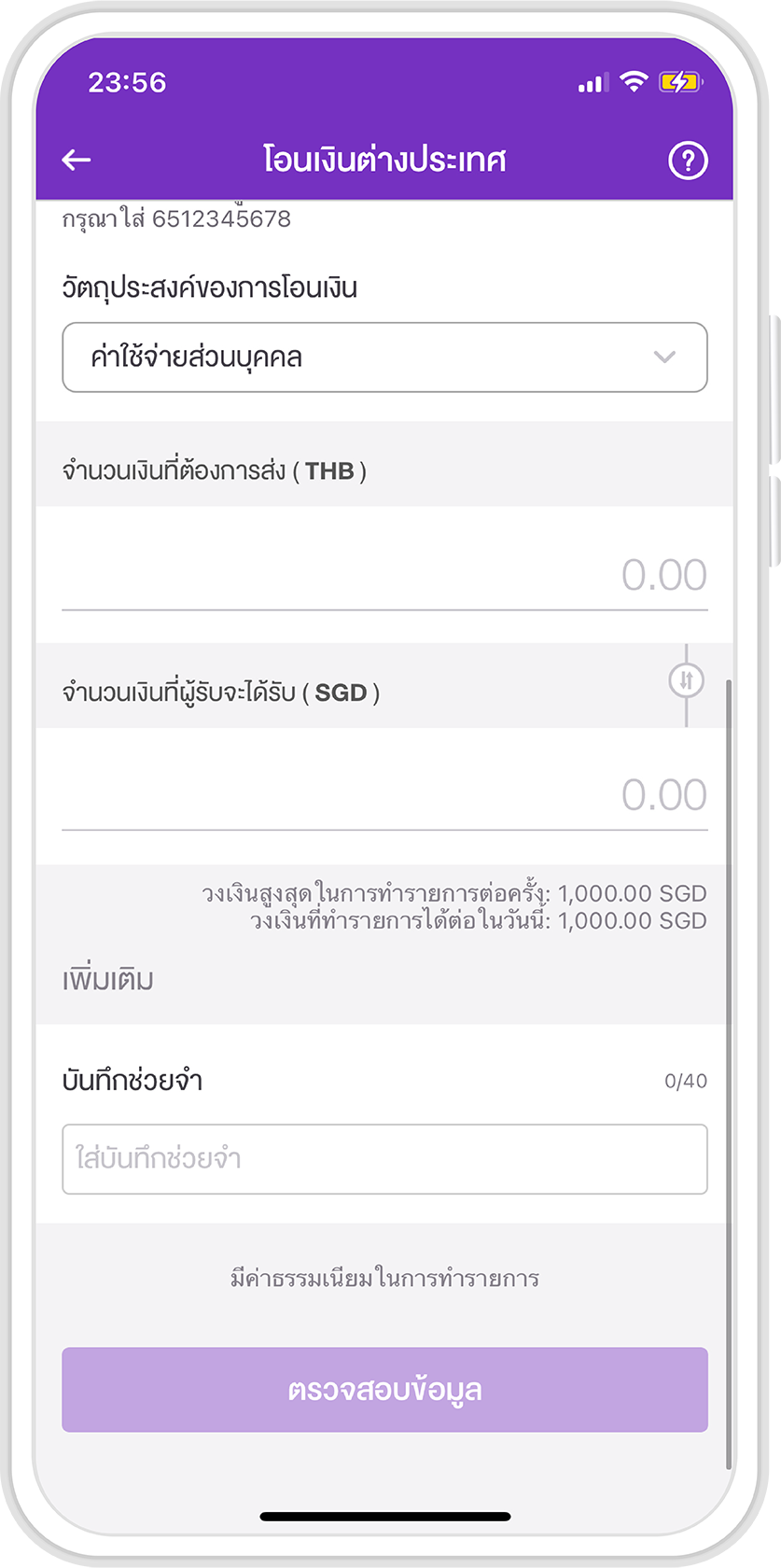

5. Enter the amount, either in THB or SGD, and the system will calculate the exchange rate automatically.

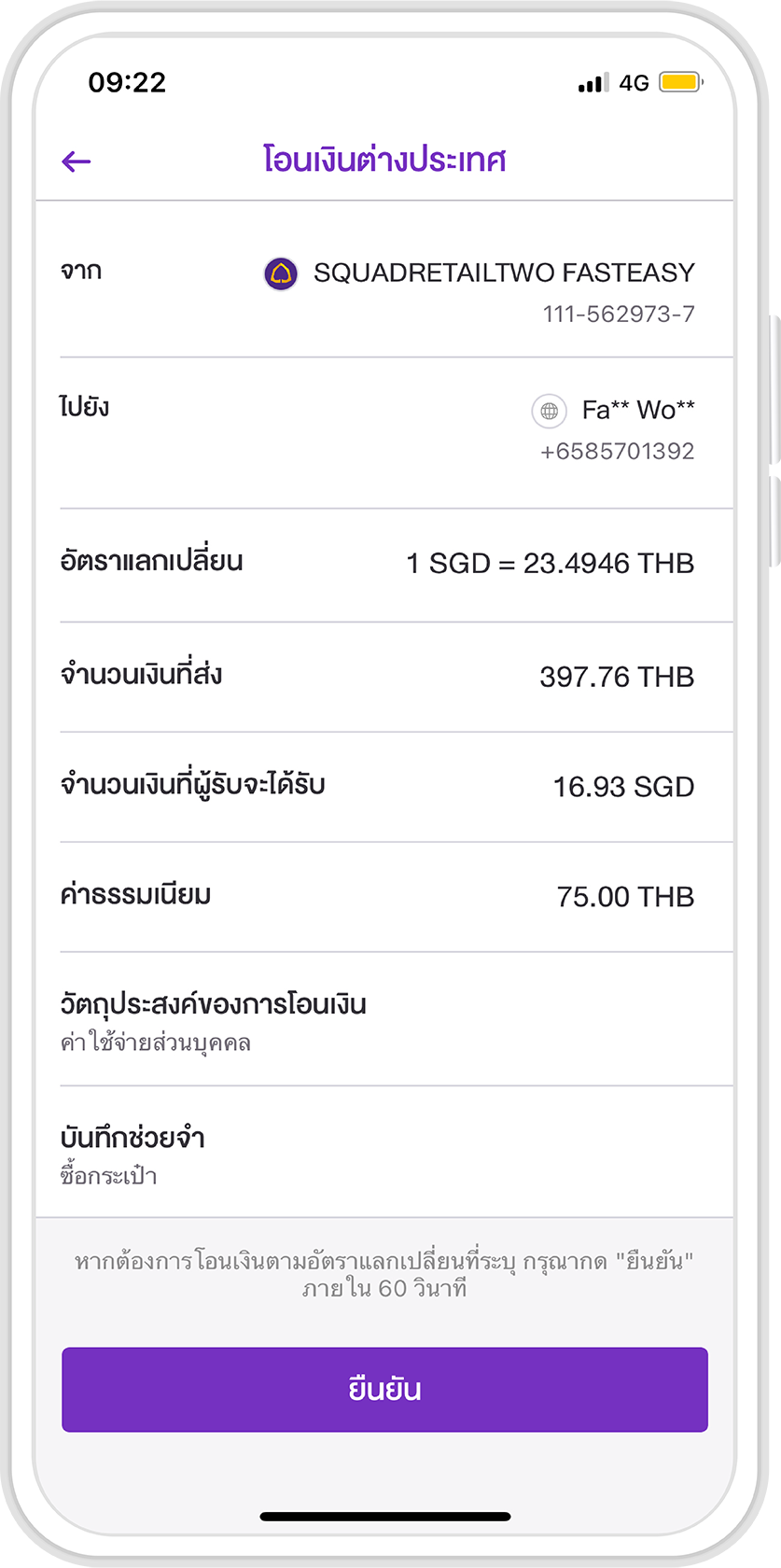

6. Tab “Review” Check your transfer details and choose “Confirm” to continue.

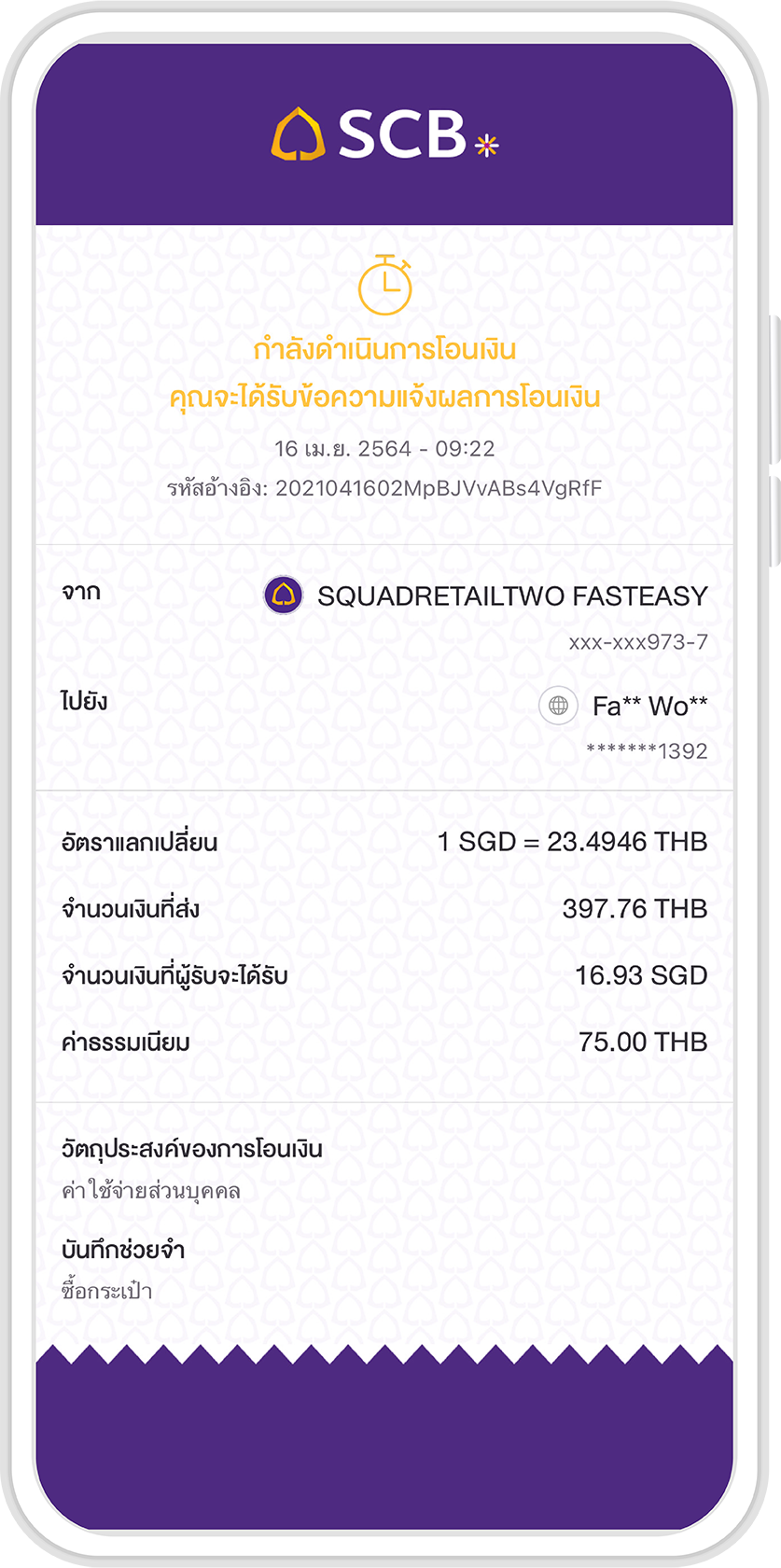

7. The system will display an e-slip. The sender will receive 2 notifications:

• First: “The transaction is being processed.”

• Second: “Your transfer is successful.”

1. Log in to the SCB Easy app and choose “Banking Services”. Choose “International Transfer”.

2. Choose the “Account”.

3. Choose “Singapore”.

4. Choose the “Mobile Number”. Enter the “Mobile number” of the beneficiary.

5. Enter the amount, either in THB or SGD, and the system will calculate the exchange rate automatically.

6. Tab “Review” Check your transfer details and choose “Confirm” to continue.

7. The system will display an e-slip. The sender will receive 2 notifications:

• First: “The transaction is being processed.”

• Second: “Your transfer is successful.”

Remarks:

- For exchange rates, SCB will use a spot rate or forward rate at its discretion.

- Transfers not in compliance with Bank of Thailand regulations will not be processed.

- SCB reserves the rights to refrain from providing service to those who are blacklisted by the OFAC or any prohibited group of people or entities on the sanction list.