For existing

clients who have made instalment payments for at least 6 months with a minimum payment of 10,000 baht for the principal amount.

clients who have made instalment payments for at least 6 months with a minimum payment of 10,000 baht for the principal amount.

interest rates

interest rates

For approved clients receiving a salary via an SCB savings account

| Approved credit line (baht) | Interest rate (p.a.) |

|---|---|

| 500,000 and over | 12.99% |

| 150,000 - 499,999 | 16% |

| 100,000 - 149,999 | 18% |

| 50,000 - 99,999 | 21% |

| 10,000 - 49,999 | 24% |

For employees

| Approved credit line (baht) | Interest rate (p.a.) |

|---|---|

| 500,000 and over | 15% |

| 150,000 - 499,999 | 17% |

| 100,000 - 149,999 | 19% |

| 50,000 - 99,999 | 25% |

| 10,000 -49,999 | 25% |

For business owners

| Approved credit line (baht) | Interest rate (p.a.) |

|---|---|

| 500,000 and over | 17% |

| 150,000 - 499,999 | 19% |

| 100,000 - 149,999 | 21% |

| 50,000 - 99,999 | 25% |

| 10,000 - 49,999 | 25% |

interest rates

interest rates

Interest rates are 15-25% p.a. or equivalent to the interest rate as per the existing UP loan contract. The minimum instalment period is 12 months, and the maximum instalment period is 72 months.

interest rate conditions

interest rate conditions

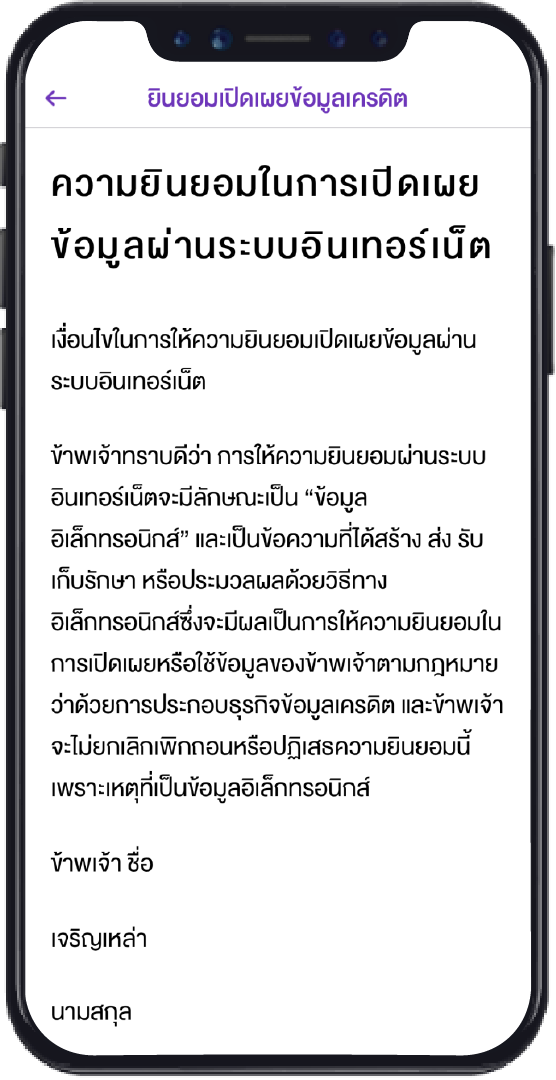

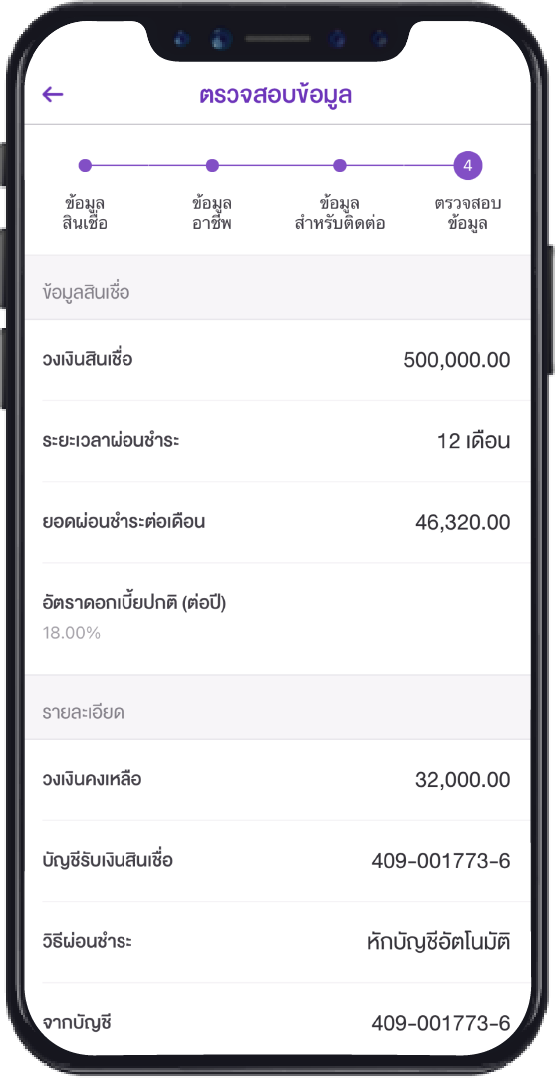

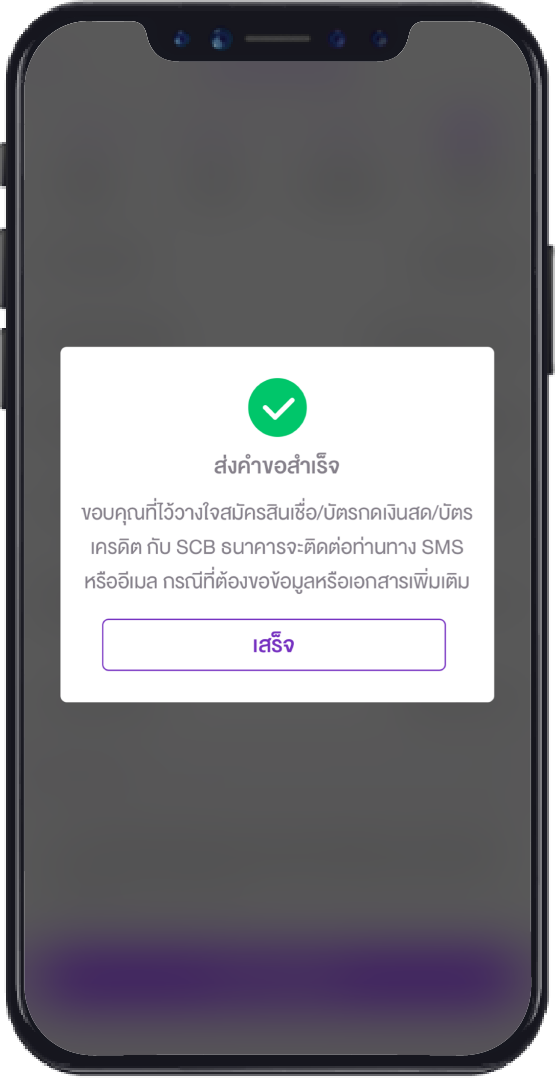

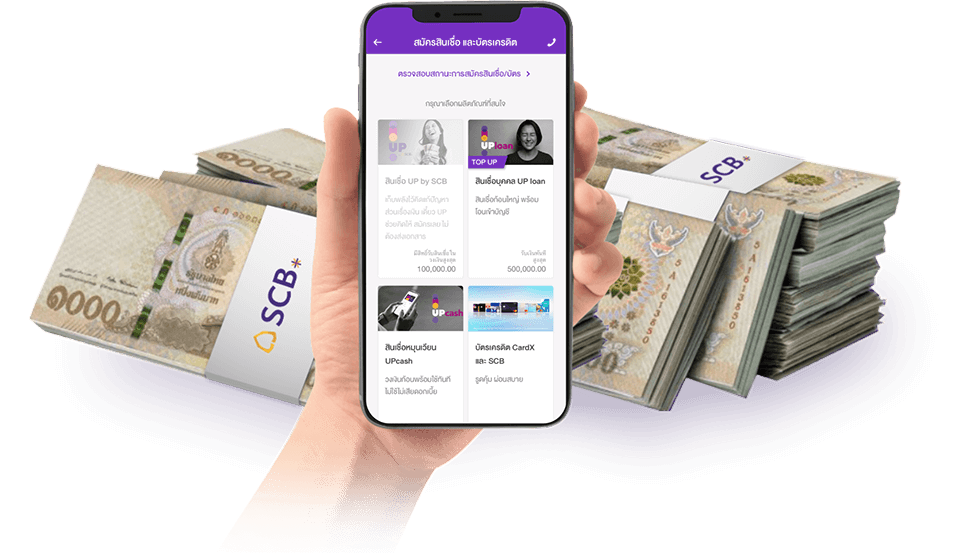

- Existing UP loan clients who have made instalment payments for at least 6 months with a minimum payment of 10,000 baht for the principal amount will be invited through SCB marketing media to apply for an UP loan Top Up via the SCB EASY app. The invited clients may apply for an UP loan Top Up amount within the paid back principal amount as shown on the app screen during the application process.

- An offered interest rate for each client depends on their existing UP loan contract or starting from 15% p.a. Clients can check the interest rate on the app screen before submitting their loan application.

- Instalment periods may vary, subject to SCB’s consideration and conditions.

- Credit approval conditions are as specified by SCB.

- When your UP loan Top Up is approved, your existing UP loan contract will be closed. The loan amounts will be combined in a new UP Loan contract. An instalment amount will follow the new UP loan contract.

- If any additional supporting document is required, SCB will contact clients via such channels as e-mail, etc.

- Default rate is 25% p.a. maximum (the highest default rate as per the loan contract + 3% on top) for the principal amount of default instalments.

- For more information, call the SCB Call Center at 02-7777777.