I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Digital Banking

- Discontinuation of SCB EASY NET (Internet banking)

- Personal Banking

- ...

- Discontinuation of SCB EASY NET (Internet banking)

SCB EASY NET

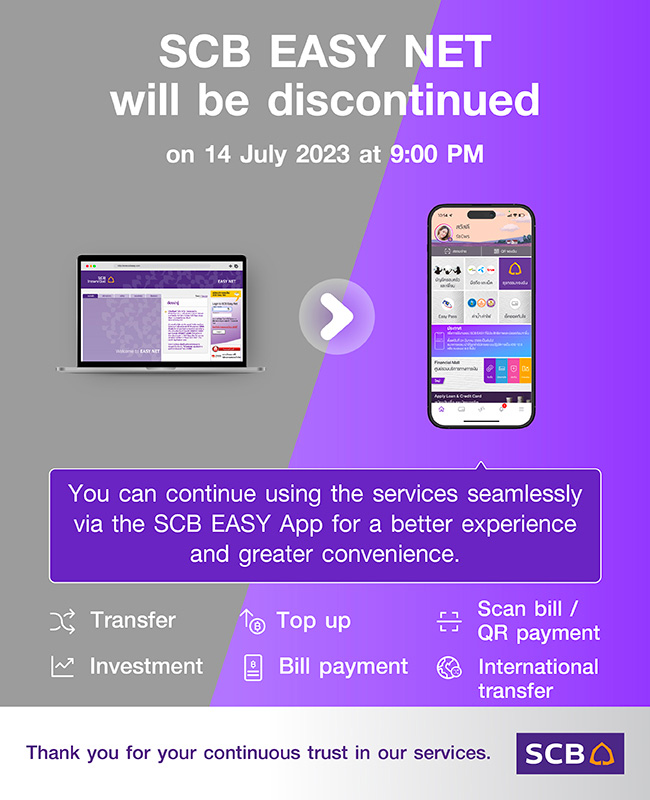

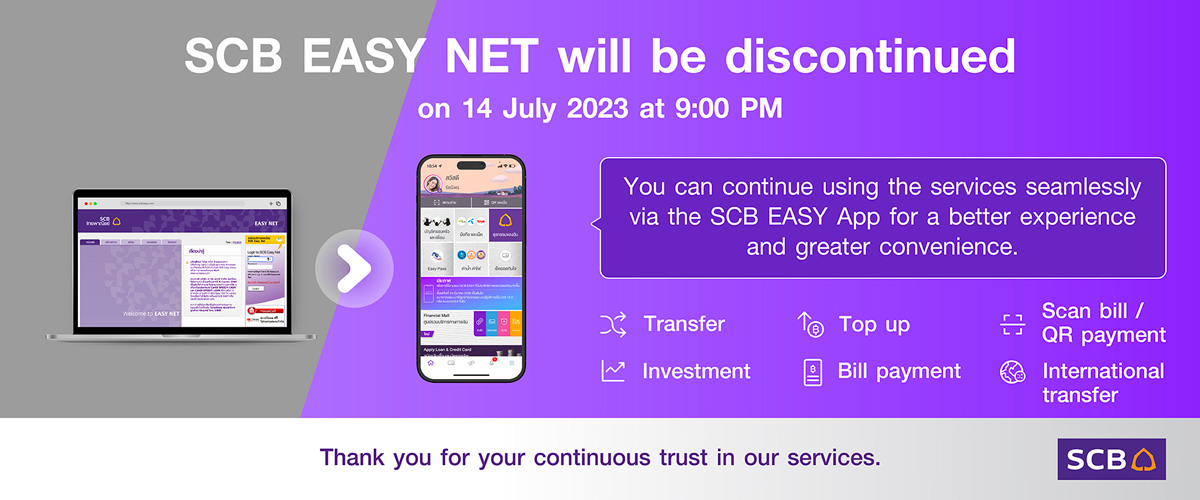

Discontinuation of SCB EASY NET (Internet banking)

Customers can continue using the services via the SCB EASY (mobile banking) application.

-

Discontinuation o...

- ดาวน์โหลดแอป

Using the services via the SCB EASY (mobile banking) application is more secure

Facial recognition for financial transaction authentication

PIN setting for financial transaction authentication

Facial recognition for financial transaction authentication

PIN setting for financial transaction authentication

SCB EASY NET users can continue using services and making financial transactions seamlessly via the SCB EASY App as follows:

1. Deposit Account Opening

2. Account Summary

3. Transfer/Top-up/Bill Payment/QR PromptPay

4. International Fund Transfer

5. Cardless ATM Withdrawal

6. Mutual Fund Sale and Purchase

7. Apply and manage Home Loans, Credit Cards, and Auto Loans

8. Apply and manage Debit Cards, ATM Cards, and Prepaid Cards

9. Schedule Transfers

10. Other extra financial services, such as EASY Bonus and Just4U (your smart personal financial assistant), etc.

1. Deposit Account Opening

2. Account Summary

3. Transfer/Top-up/Bill Payment/QR PromptPay

4. International Fund Transfer

5. Cardless ATM Withdrawal

6. Mutual Fund Sale and Purchase

7. Apply and manage Home Loans, Credit Cards, and Auto Loans

8. Apply and manage Debit Cards, ATM Cards, and Prepaid Cards

9. Schedule Transfers

10. Other extra financial services, such as EASY Bonus and Just4U (your smart personal financial assistant), etc.

*Remarks

Please note that fund transfers and bill payments on SCB EASY NET scheduled from 14 July 2023 onward will be automatically canceled. Customers can schedule them again via the SCB EASY app. Direct debit transactions set via SCB EASY NET shall remain effective as usual.

Able to access the SCB EASY NET service until July 14, 2023 at 8:59 PM.

Discontinuation of SCB EASY NET Q&A

1. Why is SCB EASY NET being discontinued ?

Due to some limitations of SCB EASY NET, certain services and enhanced security features cannot be further developed. SCB has therefore decided to discontinue the service. In this regard, the SCB EASY app is recommended for our customers instead, providing a better customer experience and more enhanced security for banking services and financial transactions, including facial recognition and PINs for authenticating transactions and more.

2. After the discontinuation of SCB EASY NET, what SCB channels can I use for services and making transactions ?

You may use services and make transactions via the SCB EASY app, SCB branches, and ATMs. For convenient transactions at your fingertips, you can download the SCB EASY app as per the following instructions:

-

For iOS

Go to the App store. Search "SCB EASY" > Select "SCB EASY App" > Tap “Install” and follow the instructions. -

For Android

Go to the Google Play store. Search "SCB EASY" > Select "SCB EASY App" > Tap “Install” and follow the instructions. -

For Huawei

Go to the Huawei App Gallery. Search "SCB EASY" > Select "SCB EASY App" > Tap “Download” and follow the instructions.

3. What information is needed to register as an SCB EASY app user ?

Please prepare the following information:

- Your Smart ID card, passport, or alien identification card number.

- Your ATM, debit, or credit card numbers.

- Your SCB deposit account numbers and/or the number of other SCB products you are using (if you wish to make balance inquiries and manage the accounts via the SCB EASY app).

For more info, visit https://scb.co.th/th/personal-banking/digital-banking/scb-easy/get-start.html

4. What banking services are available on the SCB EASY app ?

Banking services available 24/7 on the SCB EASY app include the following:

- Opening accounts via the app

- Frequent financial transactions such as fund transfers, bill payments, QR code payments, cardless ATM withdrawals, etc.

- Other interesting financial and investment products, such as credit cards, mutual funds, insurance, home loans, auto loans, etc.

- Other extra financial services, such as EASY Bonus offers, Just4U (Intelligent personal financial advisor), and more

5. I have scheduled transactions on SCB EASY NET. Will they remain effective after the discontinuation of SCB EASY NET ?

Please note that fund transfers and bill payments on SCB EASY NET scheduled to be effective from 14 July 2023 onward will be automatically canceled. You may schedule them again via the SCB EASY app.

6. Will direct debit transactions set via SCB EASY NET remain effective after the discontinuation of SCB EASY NET ?

Direct debit transactions set via SCB EASY NET shall remain effective as usual. To cancel any direct debit transaction, please directly contact the biller.

7. I applied for SMS Alert service via SCB EASY NET. Will the service remain effective after the discontinuation of SCB EASY NET ?

You will continue receiving SMS alerts for transactions made with the registered account as usual.

Should you wish to cancel or change the SMS Alert service, please visit any SCB branch nationwide or call the SCB Call Center at 02-777-7777 (24/7).

8. How can I make international fund transfers via the SCB EASY app ?

You can make international fund transfers in 4 currencies to 12 countries via the SCB EASY app. Open the app and follow these instructions:

- Go to “My Transactions.”

- Tap “International Fund Transfer.”

- Select the fund recipient’s destination country.

- Enter an amount.

The fee is 199 baht/transaction. (The fee is subject to change. You can check the most updated fees at www.scb.co.th)

The 4 currencies available for international fund transfers via the SCB EASY app are as follows:

- GBP to fund recipients in the UK

- SGD to fund recipients in Singapore

- EUR to fund recipients in Austria, Belgium, France, Germany, Ireland, Italy, the Netherlands, Portugal, and Spain

- USD to fund recipients in the US

For international fund transfers to other countries, please visit any SCB branch nationwide. The fee is 550 baht/transaction (subject to change).

For more info, visit https://scb.co.th/th/personal-banking/other-services/international-money-transfer.html

9. How can I check information about or make transactions with joint accounts, “and/or,” “for,” and “by,” accounts ?

You can check information or make transactions with joint accounts, “and/or,” “for,” and “by,” accounts at any SCB branch nationwide.