I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- 6 important issues to keep an eye on in ESG investment theme

- Personal Banking

- ...

- 6 important issues to keep an eye on in ESG investment theme

6 important issues to keep an eye on in ESG investment theme

Environmental Governance Issues (Environment: E), Society (Social: S), and Governance (Governance: G), collectively referred to as ESG, are increasingly important issues in the investment world, which the SCB CIO sees as having 6 Key points in investing in ESG trends to keep an eye on at this time include:

1. The ESG trend has received a lot of attention from all sectors (both public and private), especially after 2016.

2. ESG mutual funds continue to grow and stand out in Europe encouraging ESG funds to become more important in the mutual fund market.

3. Greenwashing or green bleaching It is an ESG risk issue that needs to be monitored, which may affect companies in the market and mutual funds.

4. ESG Rating has a positive correlation with the company's return on investment. But in the short term, the above relationship may be overshadowed by economic risks at some point in time.

5. Investment in ESG group is appropriate for long-term investments rather than expecting short-term returns. ESG Rating is one of the key factors that investors choose to invest in, while ESG Group provides returns that consider volatility. (Risk-Adjusted Return) is higher than Non-ESG group, which makes ESG investment suitable as an alternative in a situation of high economic/financial volatility.

6. Climate Change Theme is still the mainstream that is interesting to invest in. This is partly driven by global forums such as the United Nations Conference on Climate Change 2022 (COP27).

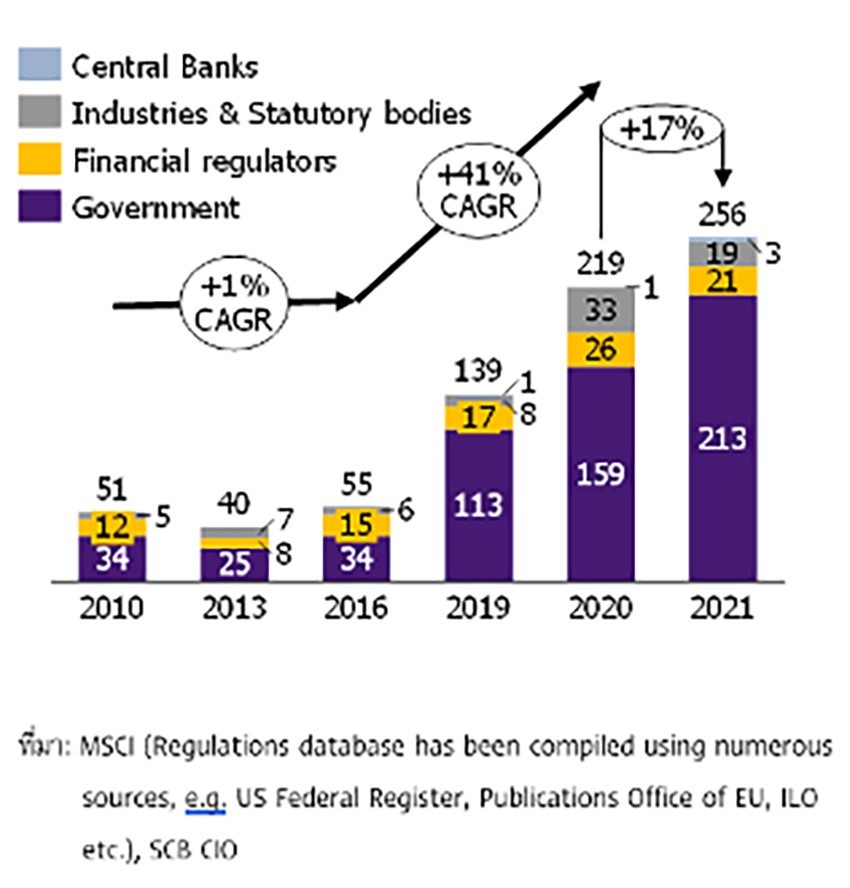

According to a study conducted by SCB CIO, interest in ESG issues clearly accelerated after 2016, reflected by the fact that government regulators in many parts of the world have issued a leapfrog regulation regarding ESG. From 2016 to 2020, the number of ESG regulations grew at an average of 41% per year and by 2021 it grew by 17%. The increase in regulation has resulted in the private sector becoming more aware of ESG, including producers, consumers, financial institutions and investors.

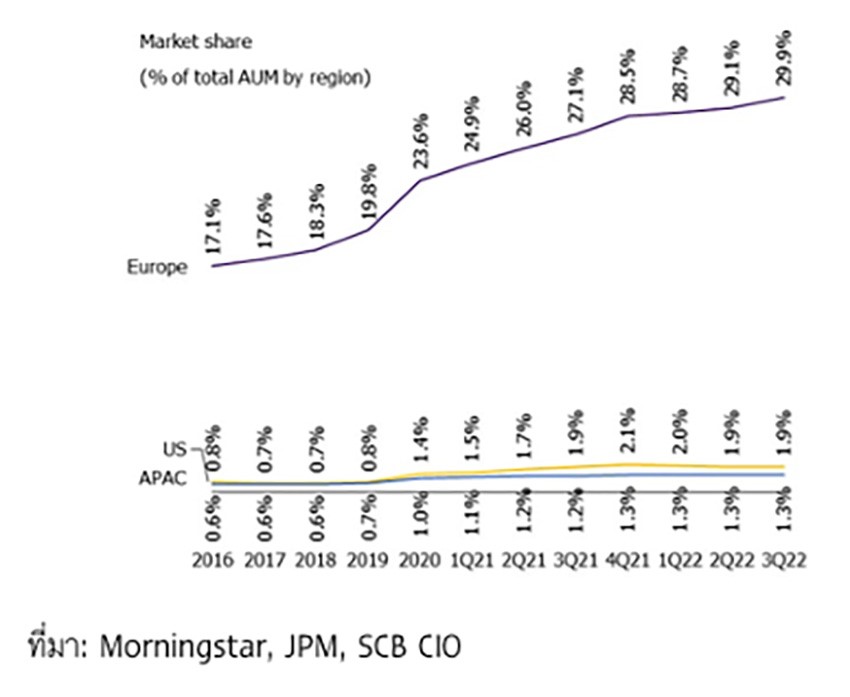

In terms of investment, ESG mutual funds continue to grow. In 2016-2021, the net asset value (AUM) of mutual funds with an ESG investment policy grew at an average of almost 30% per year, driving the market share of ESG funds to increase from 3% in 2016 to 6% in 2021 and flat in 2022. Europe is the most prominent player in ESG mutual funds, with market share of ESG funds reaching almost 30% of total AUM in Europe.

Number of ESG regulations worldwide by regulatory group

The interest in ESG comes with a number of risk areas to keep an eye on, including greenwashing, or the processes that companies use. It pretends to comply with ESG guidelines, but in reality it is not or call for short that green bleaching In the past, there was an example of a fund claiming to select stocks based on ESG factors, but it was later verified that it was not true. result in being punished and there is a problem with customers withdrawing investments The parent company's stock price fell sharply. But governments in many countries are trying to regulate and prevent greenwashing, especially in developed countries (DM).

When looking at investors, it is found that there is a tendency to pay more attention to the factor of ESG rating or ESG Rating in investment. In Europe, where ESG standards have been established, it was found that during 2018-2021, More investment flows into Article 9 mutual funds (strong ESG) than Article 8 mutual funds (some ESG promotion). Investors, especially the new generation, both Gen Y and Gen Z, consider ESG Rating an important factor affecting investment decisions. second only to return on investment

Meanwhile, when analyzing the risk-adjusted return of the ESG group was found to be higher than that of the non-ESG group, making ESG investment another attractive alternative amid the current global economic and financial volatility.

In the short term, the correlation of return on investment with ESG Rating may change. according to the impact of the economy at that time as happened during the year 2022 when world oil prices accelerated a lot. As a result, fossil energy producers and companies benefiting from high oil prices which is a group with a lower ESG Rating, yielded quite outstandingly in the first half of 2022.

Companies that use new technology and innovation to reduce environmental damage, with higher ESG ratings, perform worse than the fossil energy sector, including the MSCI World Index that excludes fossil energy. This is because most of these tech companies are categorized as technology stocks or high growth stocks. This weakens yields during rising interest rates.

ESG Funds do not perform better in every economic period. Especially during a period of accelerating oil prices and rising interest rates.

Overall, the SCB CIO believes that the ESG investment theme is an attractive theme for long-term investment. more than expected short-term returns When considering the overview of ESG funds, what is the investment policy? 85% of total ESG funds accounted for 85% of total ESG funds, with only 15% of thematic ESG funds. Fund), almost half of which are groups focused on climate action (Climate Action).

This is because solving the problem of climate change or Climate Change is an issue that the United States, Europe and China discuss a lot. The United Nations Conference on Climate Change 2022, or COP27, is there to help accelerate interest. This leads to the push for the energy transition and the circular economy, which are important parts that create investment opportunities. and future growth prospects for the Renewable Energy and Energy Storage businesses.

As ESG issues become increasingly important to the sustainability of the planet, The investment sector cannot ignore this issue either. Because the investment portfolio will be able to generate good returns in the long run and be sustainable. Inevitably, it must be an investment portfolio with investments taking into account ESG as well.

Head of SCB Chief Investment Office

Information as o f 13 Feb 2023

source : The Standard Wealth