I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Other Services

- International money transfer

- International money transfer via the SCB EASY App

- Personal Banking

- ...

- International money transfer via the SCB EASY App

International money transfer

International money transfer via the SCB EASY App

More convenient, faster, and more cost-effective for 26 countries and 17 currencies.

Product Detail

New! International money transfer via the SCB EASY App offers more convenient, faster, cheaper, and savvier with Blockchain technology via RippleNet.

International money transfer via the SCB EASY App offers more convenient, faster, cheaper, and savvier!

More convenient

Download the app and it’s ready to use 24/7 anywhere. No need to go to branch, reduced paperwork, no supporting documents required, and receive notification upon fund availability in the recipient’s account.

Faster

Powered by Blockchain technology via RippleNet, a recipient is able to receive fund, depending on the remittance system at the destination country.

| COUNTRY | CURRENCY | ESTIMATED TRANSFER TIME | CAP LIMIT PER TRANSACTION |

|---|---|---|---|

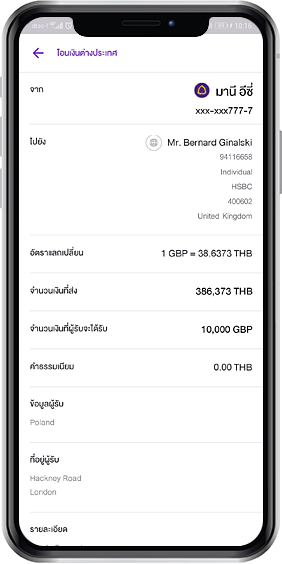

| United Kingdom | GBP | Immediately to 1 business day | THB 1,500,000 |

| Singapore | SGD | Immediately to 1 business day | THB 1,500,000 |

| EU (France, Germany, Italy, Spain, the Netherlands, Ireland, Austria, Belgium, Portugal, Finland, except Sweden, and Denmark) | EUR | Immediately to 2 business days | THB 1,500,000 |

| Sweden | SEK | Immediately to 2 business days | THB 1,500,000 |

| Denmark | DKK | Immediately to 2 business days | THB 1,500,000 |

| United States | USD | Within 5 business days | THB 1,500,000 |

| Australia | AUD | Within 2 business days | THB 1,500,000 |

| Canada | CAD | Within 2 business days | THB 1,500,000 |

| China (to Alipay) | CNY | Immediately to 1 business day | CNY 50,000 |

| Hongkong | HKD | Immediately to 1 business day | HKD 50,000 |

| Indonesia | IDR | Immediately to 1 business day | IDR 50,000,000 |

| India | INR | Immediately to 1 business day | THB 1,500,000 |

| Japan | JPY | Within 2 business days | JPY 1,000,000 |

| South Korea | KRW | Immediately to 1 business day | KRW 5,000,000 |

| Malaysia | MYR | Within 2 business days | MYR 100,000 |

| the Philippines | PHP | Immediately to 1 business day | PHP 50,000 |

| Cambodia | USD | Immediately to 1 business day | THB 1,500,000 (ABA Bank) USD 2,500 (ACELEDA BANK) |

| Vietnam | VND | Immediately to 1 business day | VND 99,999,999.99 |

Cheaper

- Recipients receive the full transferred amount for each transaction, with no additional deductions by the destination bank.

- The standard transaction fee starts at 199 THB per transaction.

- Available in 17 currencies: GBP, SGD, EUR, SEK, DKK, USD, AUD, CAD, CNY, HKD, RPD, INR, JPY, KRW, MYR, PHP, and VND to 26 destination countries: the United Kingdom, Singapore, France, Germany, Italy, Spain, the Netherlands, Ireland, Austria, Belgium, Portugal, Denmark, Finland, Sweden, United States, Australia, Canada, China, Hongkong, Indonesia, India, Japan, South Korea, Malaysia, the Philippines, Cambodia, Vietnam

- For other currencies/destination countries, CLICK

Savvier

Better exchange rates and in-app notifications when funds are available in the recipient’s account.

Additional Information

- Eligible for all SCB EASY App users, both Thai citizens and foreigners with individual savings accounts.

- Available 24/7

- Eligible for accounts belonging to individual recipients.

- For recipient accounts in the UK, Singapore, China (to Alipay), Hong Kong, Indonesia, India, South Korea, Philippines, Cambodia, Vietnam, instant transfers available 24/7.

- For recipient accounts in Germany, France, Italy, Spain, the Netherlands, Ireland, Austria, Belgium, and Portugal), transactions are processed on business days, Monday – Friday between 9:00 am – 4:00 pm local time in the recipient’s country.

- Outward remittance to Finland will be temporarily unavailable, effective from January 22, 2025, until further notice.

- Outward remittance to China will be temporarily unavailable from January 27 to February 4, 2025, due to the Chinese New Year holidays.

- Outward remittance to Japan will be temporarily unavailable, effective from March 27, 2025, until further notice.

- For recipient accounts in Australia, Canada, Sweden, Denmark, and Malaysia, transactions are processed on business days and funds will be available in recipient accounts within 2 business days, depending on the bank.

- For recipient accounts in the USA, transactions are processed on business days and funds will be available in recipient accounts within 3 – 5 business days, depending on the bank.

- Transfer transactions are limited to a maximum of 20 transactions per person per month. The transfer limit is capped at 5 million baht per person per month.

- No pre-registration or document is required.

- Every transaction comes with an e-slip, automatically saved on your mobile phone. Customers can share this e-slip with the recipient as proof of the transaction.

- When transferring money to China (via Alipay) or South Korea, the recipient is required to verify their identity, following the regulations set by the destination service provider. If the recipient fails to complete the necessary verification within the designated period, the transfer will be canceled. Senders should communicate with recipients to ensure all conditions are met following the transaction.

Benefits for remittance via the SCB EASY App

- Standard transaction fee at 199-399 THB per transaction

- Regardless of the country or the transferred amount, the recipient receives the full amount.

- Quick fund availability in the recipient’s account

- Instant notification on the app when funds successfully reach the recipient's account.

- An email notification is sent when the money transfer transaction is successful.

Get remittance information ready

For a quick and smooth transaction, we recommend customers to prepare the following international money transfer information:

| COUNTRY | RECIPIENT’S ACCOUNT INFORMATION | DESTINATION BANK INFORMATION | Others Infomration (Requested by Destination) |

|---|---|---|---|

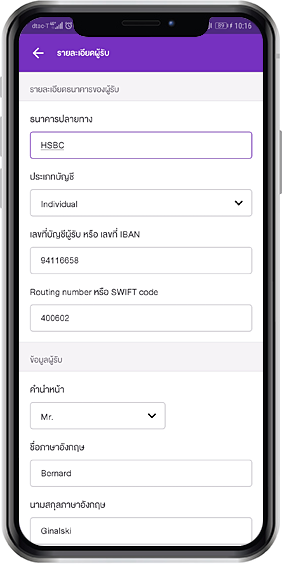

| UK | Account Number <8 digits> e.g. 75278XXX | Destination bank’s name Sort Code <6 digits> e.g. 750XXX | Recipient’s name-surname Recipient’s nationality Recipient’s address |

| EU (France, Germany, Italy, Spain, the Netherlands, Ireland, Austria, Belgium, Portugal) | IBAN e.g. DE74100110012620925XXX | Destination bank’s name SWIFT Code <8 to 11 characters> e.g. NTSBDEB1XXX | Recipient’s name-surname Recipient’s nationality Recipient’s address |

| Denmark, Finland | IBAN e.g. DE74100110012620925XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality |

| Sweden | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name Branch number <depending on each bank> e.g. 5XX | Recipient’s name-surname Recipient’s nationality |

| USA | Account Number <depending on each bank> e.g. 001087263XXX | Destination bank’s name ACH Code (Routing Number) <9 digits> e.g. 121000XXX | Recipient’s name-surname Recipient’s nationality Recipient’s address |

| Singapore | Account Number <depending on each bank> e.g. 687194704XXX | Destination bank’s name SWIFT Code <8 to 11 characters> e.g. OCBCSGSGXXX | Recipient’s name-surname Recipient’s nationality |

| Canada | Account Number <depending on each bank> e.g. 687194704XXX | Destination bank’s name Routing Code <9 digits> e.g. 121000XXX | Recipient’s name-surname Recipient’s nationality |

| Australia | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name BSB Number <6 digits> e.g. 082XXX | Recipient’s name-surname Recipient’s nationality Recipient’s address |

| China (to Alipay) | Mobile number or email e.g. 251951105XXX or [email protected] | Recipient’s name-surname Recipient’s nationality | |

| Hongkong | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality |

| Indonesia | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality |

| India | Account Number <depending on each bank> e.g. 212938XXX | IFS Code <11 digits> e.g. BKID00050XXX | Recipient’s name-surname Recipient’s nationality |

| Japan | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name Branch number <depending on each bank> e.g. 5XX | Recipient’s name-surname Recipient’s nationality Recipient’s mobile number |

| South Korea | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality Recipient’s mobile number |

| Malaysia | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality |

| Philipines | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality |

| Cambodia | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality Recipient’s national ID or Passport ID Recipient’s address Receipient date of birth |

| Vietnam | Account Number <depending on each bank> e.g. 212938XXX | Destination bank’s name | Recipient’s name-surname Recipient’s nationality Recipient’s address |

How to make an international money transfer transaction

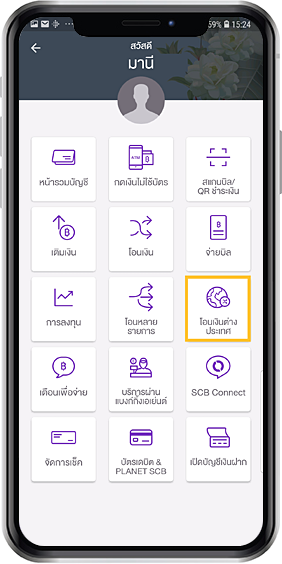

1. Log in to SCB EASY App

then select “Banking service”

2. Select “ International transfer”

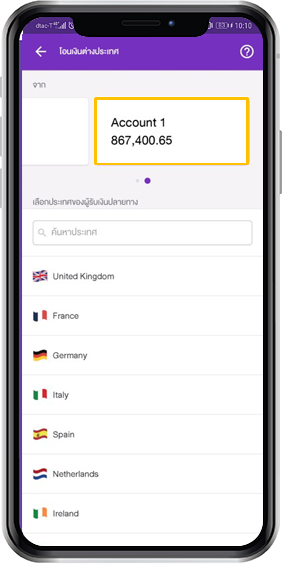

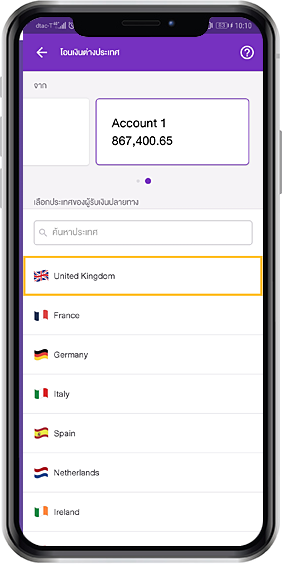

3. Select “Bank account”

4. Select “Bank account” and “Destination country”

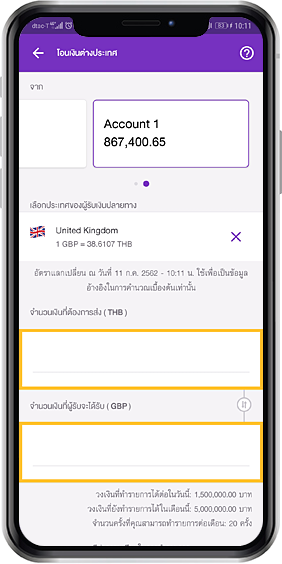

5. Input transferred amount

either in THB or Destination currency,

system will automatically

calculate exchange rate and select “Proceed”

6. Input bank details, beneficiary’s

details and address and select “Review”

7. Review information and select “confirm” to make

a transaction

8. System provides an e-slip for

proof of transaction

9. System will send out 2 notifications:

• 1st notification: SCB is processing a transaction

• 2nd notification: successfully transfer

What you should note:

- Fund availability varies by time zone and business hours of the remittance system in the destination country.

- Exchange rate for THB to foreign currencies can be either spot rate or forward rate as agreed with each bank.

- This service is not available for international money transfer transactions that are not in compliance with the Bank of Thailand’s requirements.

- SCB reserves the right to reject a transaction whereby a recipient is on the OFAC List or other lists of sanctioned parties.