I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Insurance

- Endowment Insurance

- Super-Mung-Khung 11/6 Plus

- Personal Banking

- ...

- Super-Mung-Khung 11/6 Plus

Endowment Insurance

Super-Mung-Khung 11/6 Plus

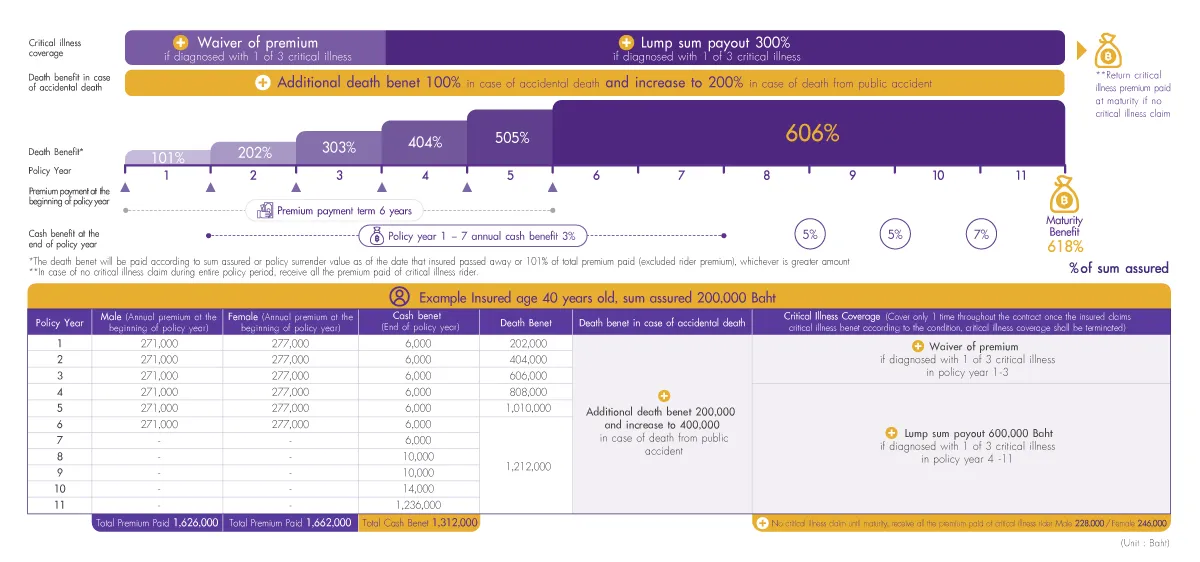

A way to build and secure your future plan with short-term premium payment, annual cash benefit, and tailor your critical illness coverage.

Highlights

A life insurance plan with annual cash benefit every year, 3 critical illness coverage, and additional death benefit in case of accident

Enjoy with cash return every year

Enjoy with cash return every year, 3% at the end of policy year 1-7, 5% at the end of policy year 8-9, and 7% at the end of policy year 10

Additional life protection

Additional life protection in the event of accidental death and doubled in case of death from a public accident

If detected

If detected, stop paying by waiver of premium if diagnosed with 1 of 3 critical illness in policy year 1 - 3

If detected

If detected, receive a lump sum upon diagnosis of 1 of 3 critical illness in policy year 4-11

No claim no waste

No claim no waste, get return all the critical illness premium paid at the time of maturity if no critical illness claim during the policy period

Easy to apply

Easy to apply with 1 health question

% of Sum Assured

- Insured by FWD Life Insurance Public Company Limited.

- SCB is only an authorized broker.

- Insurable guideline refer to Underwriting procedures of FWD Life Insurance Public Company Limited.

- Buyers must understand the details of coverage and conditions before deciding to apply

Qualification and Document Required

- Insurable age: 1 day – 70 years

- Coverage Term : 11 years

- Premium payment term : 6 years

- Minimum sum assured : 50,000 Baht

- Maximum sum assured : 2,000,000 Baht, subject to the Company's terms and conditions in calculating total maximum sum assured

- Premium payment mode: Annually

3 Critical Illnesses

- Invasive Cancer

- Major Stroke

- Acute Heart Attack

- Waiting period 90 days for critical illness coverage

- Cover for critical illness 1 time throughout the contract once the insured claims critical illness benefit according to the condition, critical illness coverage shall be terminated

- Life insurance premium and Health insurance premium (if any) can be tax-deductible according to the Notification of the Director-General of the Revenue Department on Income Tax

Benefit and Protection