I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Insurance

- Endowment Insurance

- Pra-Gun-Khum-Krong-Mung-Khung 85/8

- Personal Banking

- ...

- Pra-Gun-Khum-Krong-Mung-Khung 85/8

Endowment Insurance

Khum Krong Mung Khung 85/8

Ensure the future for your child and bring them financial security thoughtfully with guaranteed annual cash benefits, special with payor benefit

Highlights

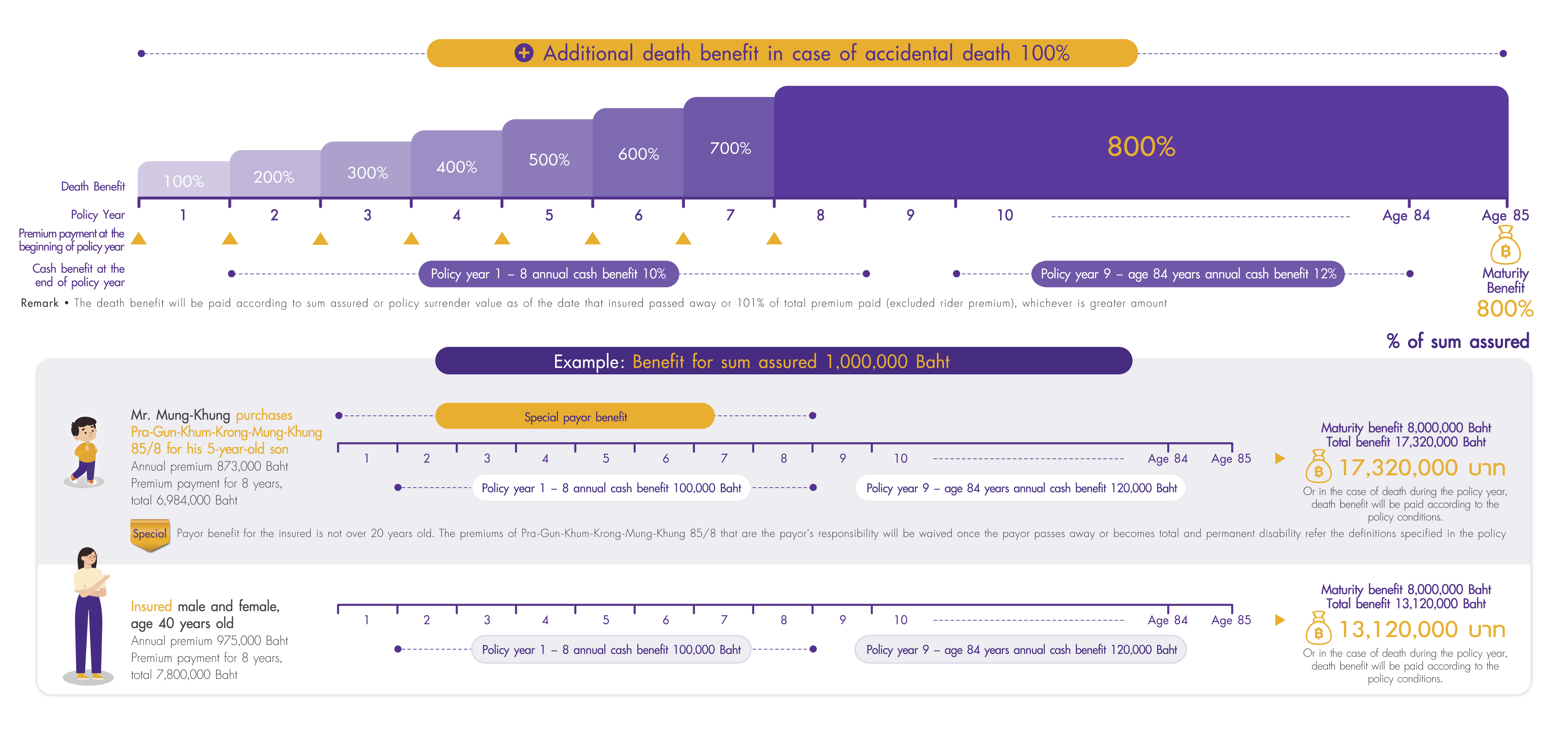

A life insurance plan with receiving annual cash benefit every year, additional death benefit in case of accident, and payor benefit

8-year premium payment

8-year premium payment, build a long-term plan for life coverage and annual cash benefits until age 85

Supports freedom life

Supports freedom life, guaranteed annual cash benefit 10% in the end of policy year 1 - 8, 12% in the end of policy year 9 - age 84 years, and maturity benefit 800%

Additional protection

Enhance peace of mind, special with payor benefit for the insured is not over 20 years old

Enhance peace of mind

Enhance peace of mind, special with payor benefit for the insured is not over 20 years old

Easy to apply

Easy to apply, no health check up and no health questions

% of Sum Assured

- Insured by FWD Life Insurance Public Company Limited.

- SCB is only an authorized broker.

- Insurable guideline refer to Underwriting procedures of FWD Life Insurance Public Company Limited.

- Buyers must understand the details of coverage and conditions before deciding to apply

Qualification and Document Required

For the insured

- Insurable age: 1 day – 60 years

- Coverage Term : Until age 85 years

- Premium payment term : 8 years

- Minimum sum assured : 50,000 Baht

- Maximum sum assured : 50,000,000 Baht, subject to the Company's terms and conditions in calculating total maximum sum assured

- Premium payment mode: Annually, Semi-annually, Quarterly and Monthly

- Underwriting : no health check up and no health questions"

For the payor (Payor benefit rider)

- Insurable age: 20 – 65 years

- Underwriting : Full underwriting

- Maximum benefit per payor : According to sum assured of base plan and maximum not over 1,000,000 Baht"

Special, payor benefit for the insured is not over 20 years old*

The premiums of Pra-Gun-Khum-Krong-Mung-Khung 85/8 (base plan) that are the payor's responsibility will be waived once the payor passes away or becomes total and permanent disability refer the definitions and conditions specified in the policy. However, the policy benefits will remain unchanged.

*Special payor benefit is for the policies where the insured aged 1 day – 20 years and the payor must meet the underwriting conditions

- Life insurance premium and Health insurance premium (if any) can be tax-deductible according to the Notification of the Director-General of the Revenue Department on Income Tax

Benefit and Protection