I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

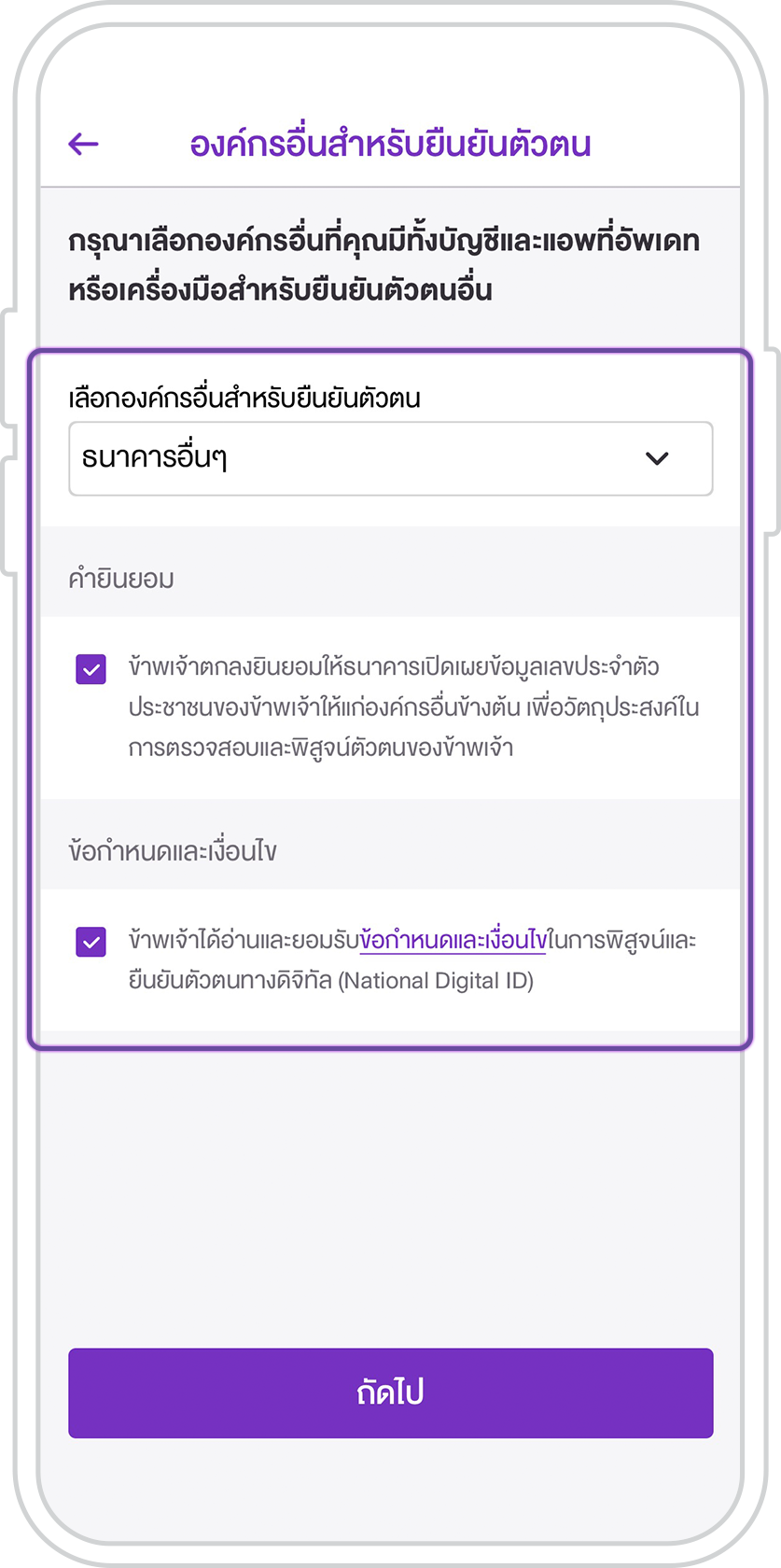

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Digital Banking

- SCB Easy App

- Open an online savings account

- Open an online savings account with National Digital ID (NDID)

- Personal Banking

- ...

- Open an online savings account with National Digital ID (NDID)

ONLINE SAVINGS ACCOUNT

Online savings account with interest up to 1.5% p.a.

from the first baht to 2 million baht.

Open an online savings account with National Digital ID (NDID) authentication via another banking application (for new customers)

บริการ NDID

Open an online savings account via the SCB EASY app in just 3 simple steps

1. Download the SCB EASY app. Select National Digital ID (NDID) authentication.

2. Select another banking application you have an account with and authenticate your identity within 1 hour.

3. Scan your face with the SCB EASY app. Select “Open an online savings account.”

Details

- Conveniently open an online savings account anywhere via the SCB EASY app.

- Earn interest of up to 1.5% p.a. from the first baht to 2 million baht -- high returns and low risk.

- No minimum amount requirement for account opening

- For new customers who have never had any SCB product (The service is provided under the Bank of Thailand’s regulatory sandbox).

- This identity authentication process requires ID card verification and an ID photo taken at the point of service.

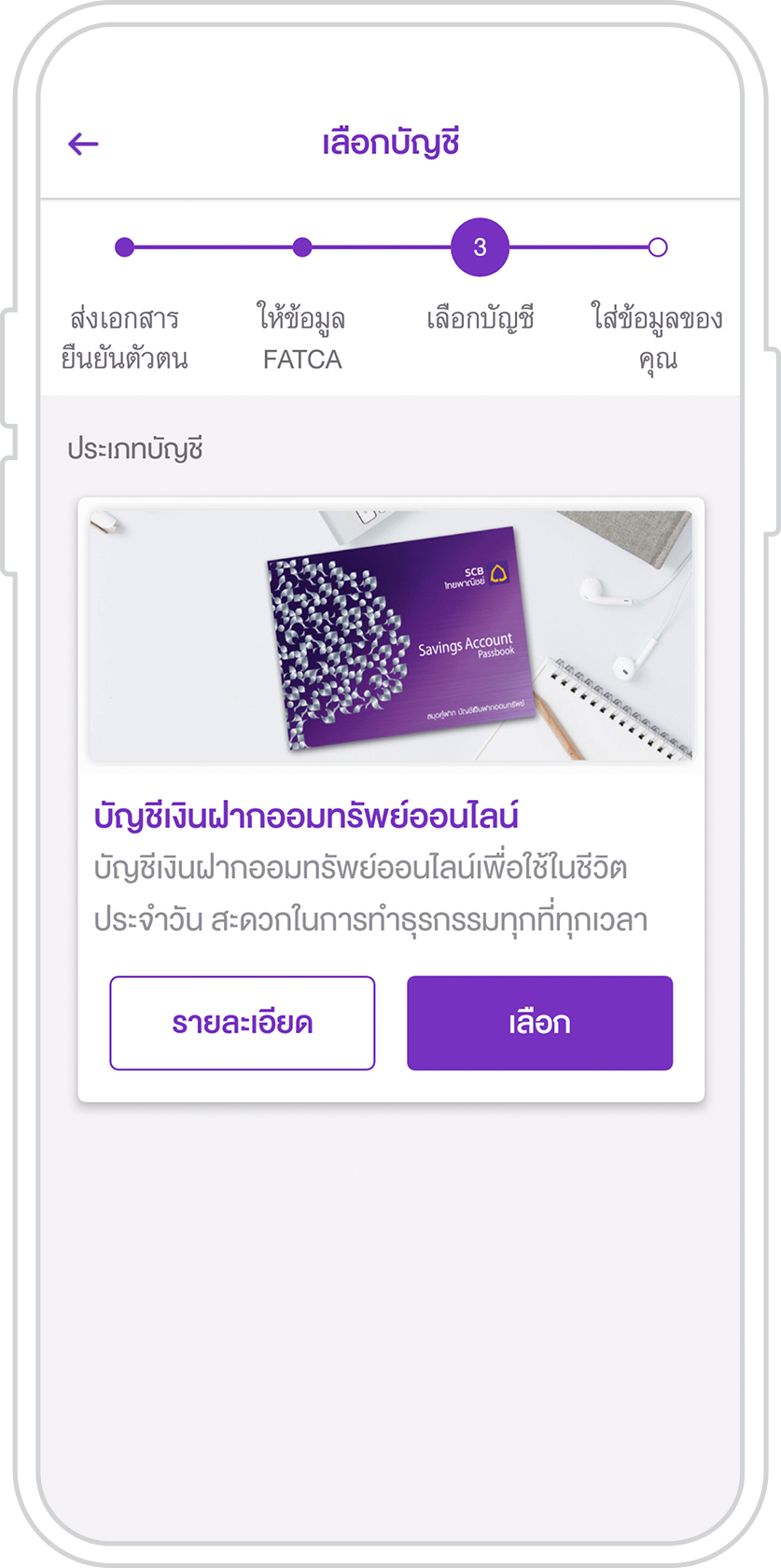

Accounts available for opening via the SCB EASY app

No-passbook (online) savings account with interest up to 1.5% for deposit amounts between 1 – 2,000,000 baht

| Deposit amount | Interest rate (p.a.) |

|---|---|

| 1 – 2,000,000 Baht | 1.50% |

| More than 2,000,000 Baht | 0.45% |

*Interest rate is 1.5% p.a. until further change as announced by SCB.

**Account opening is available via the SCB EASY app during 07:00 am – 10:30 pm only.

***Outward fund transfer limit is 100,000 baht/day (No limit for inward fund transfers). If you contact an SCB branch to add your signature to the account, the outward fund transfer limit can be over 100,000 baht/day, which will be effective for every transaction channel.

Detailed instructions on National Digital ID (NDID) authentication and online savings account opening

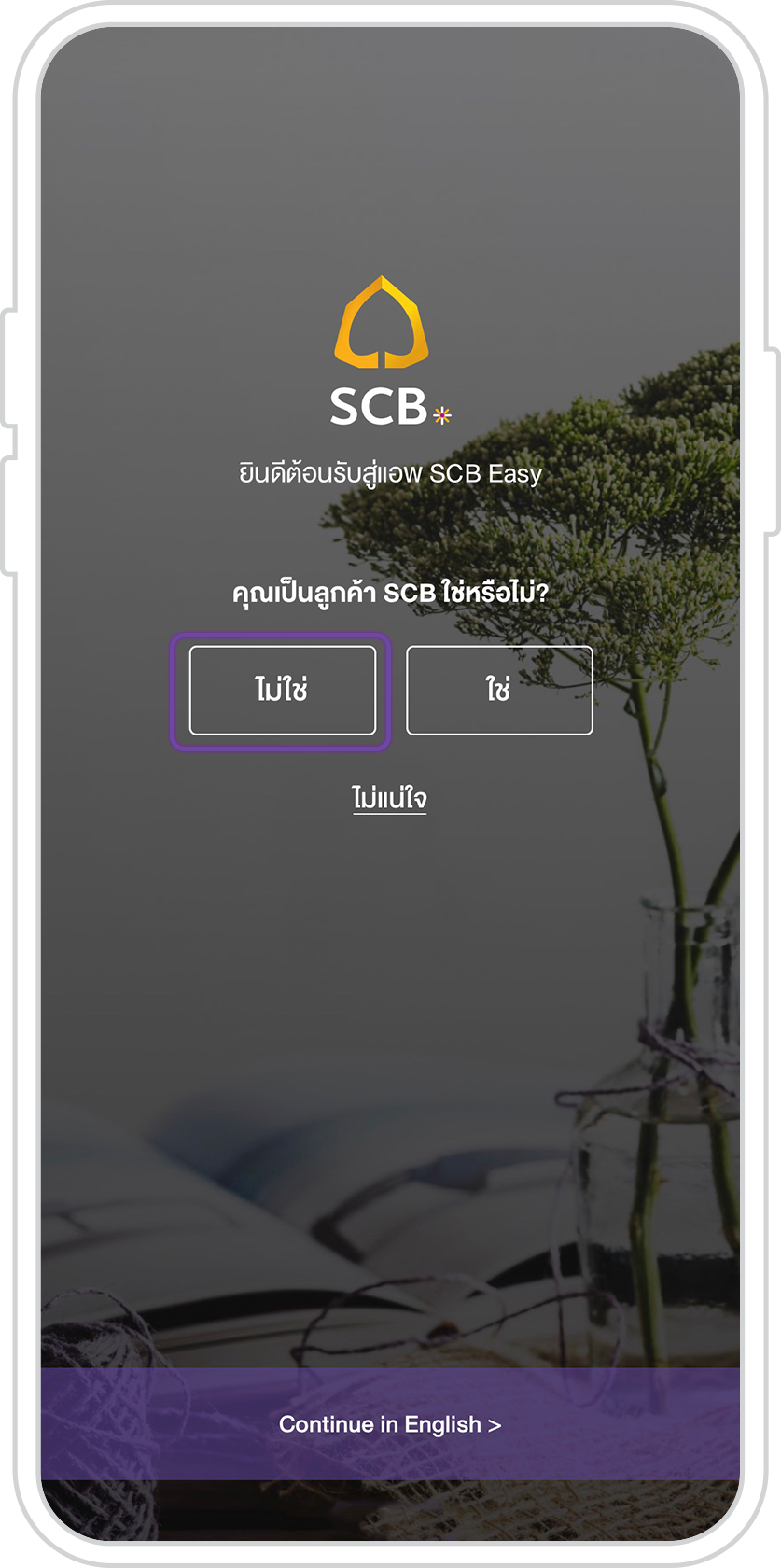

1. Download the SCB EASY app from the App Store or Google Play. Open the SCB EASY app. Select “No.”

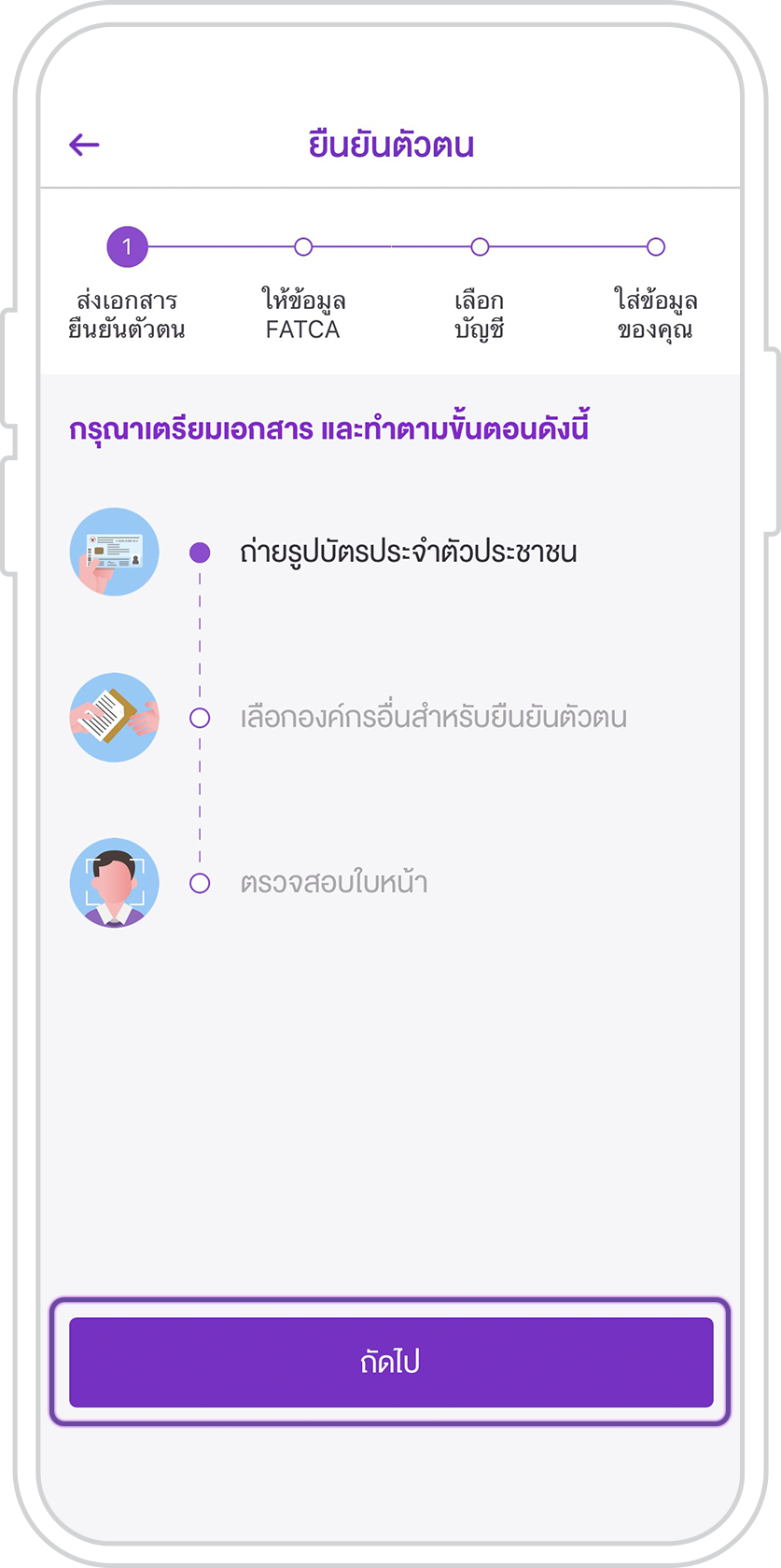

2. Select National Digital ID authentication.

3. Start identity authentication. Tap “Next.”

4. Take a photo of your ID card by placing it within the frame.

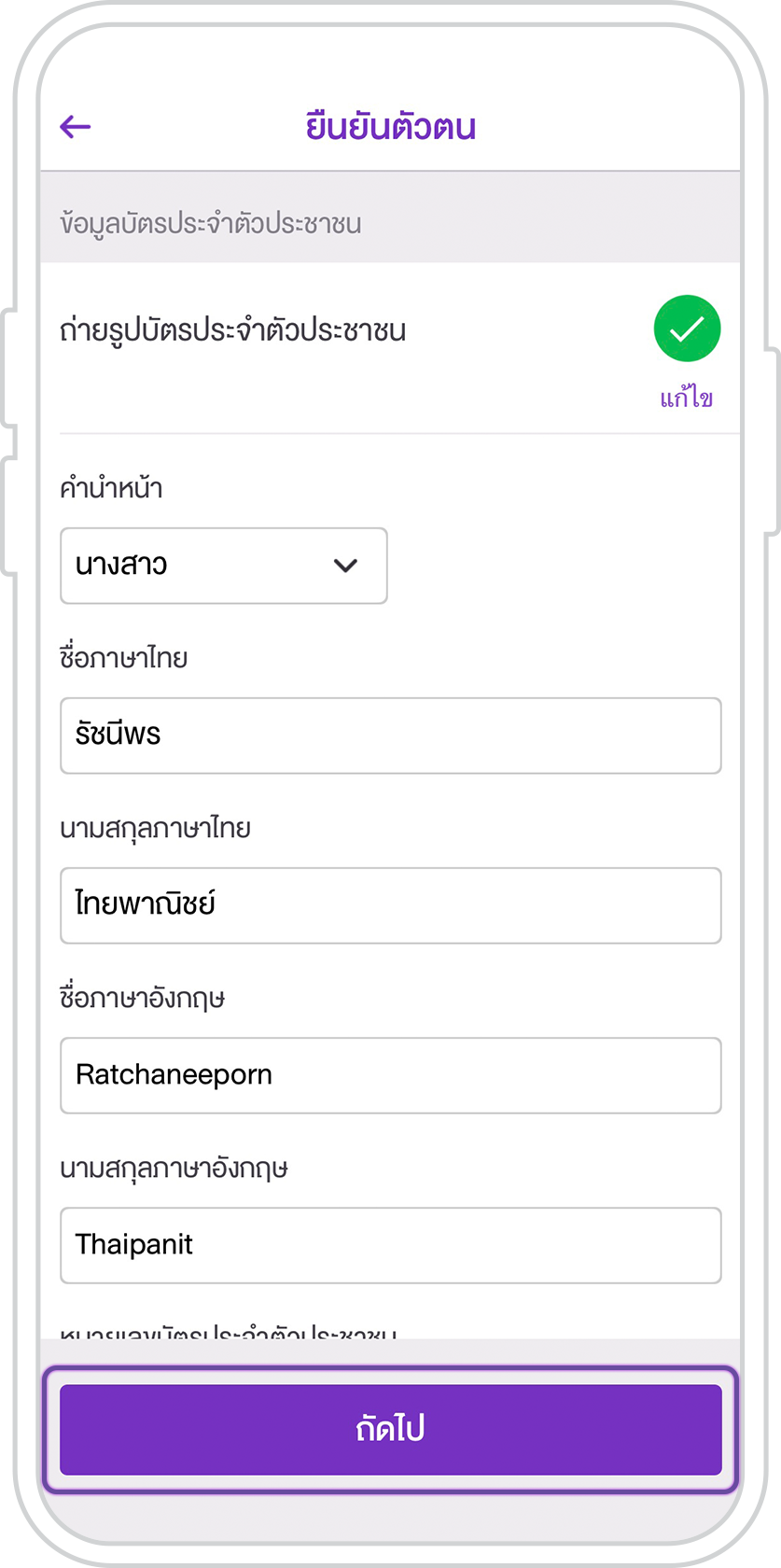

5. Enter details. Tap “Next.”

6. Select a bank for identity authentication. Tap “Next.”

7. Go to the selected bank’s app and proceed with identity authentication.

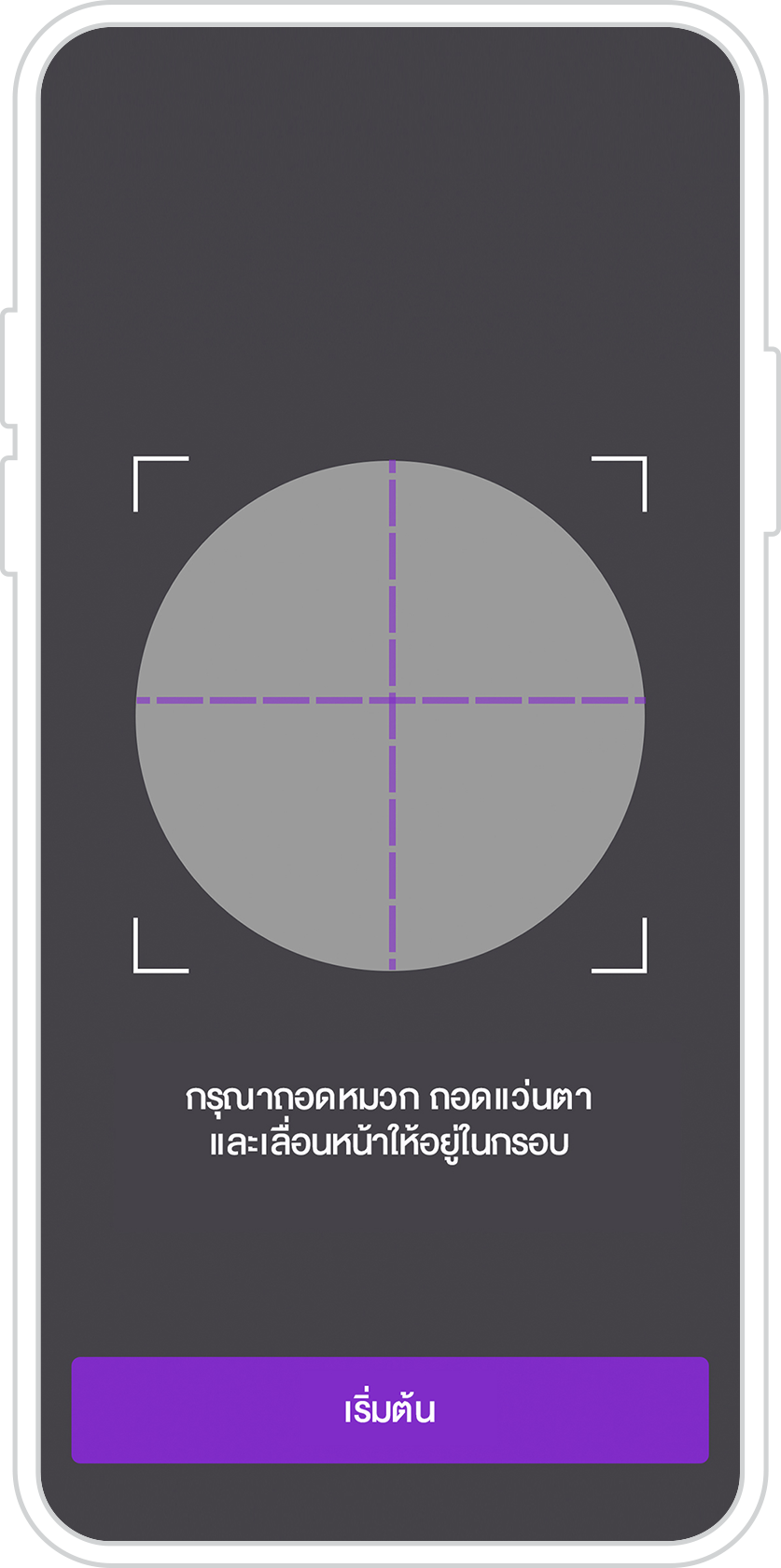

8. Start facial recognition.

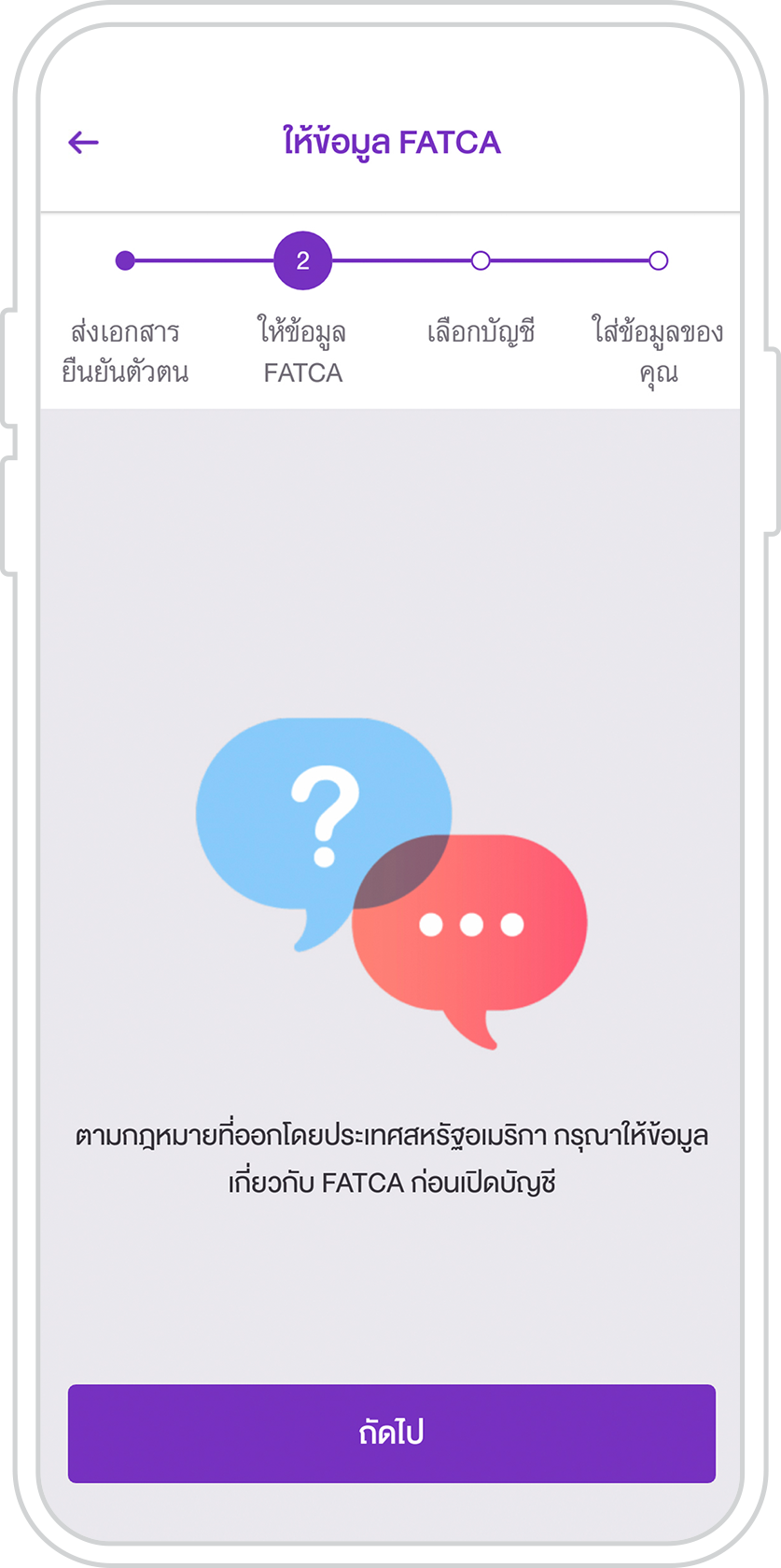

9. Tap “Next.” Answer FATCA questions.

10. Tap “Select” to view and enter details for account opening.

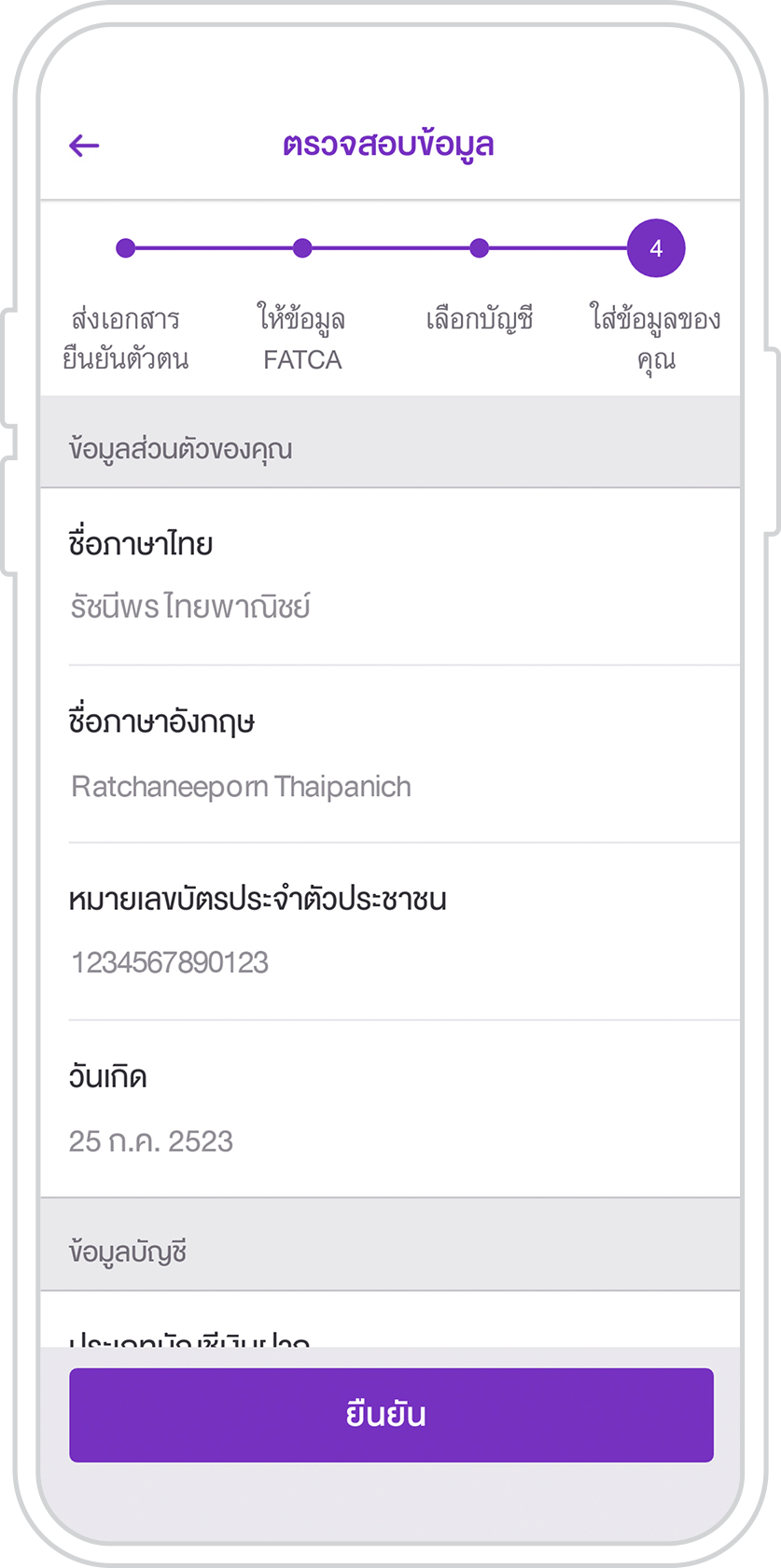

11. Review the details. Tap “Confirm.”

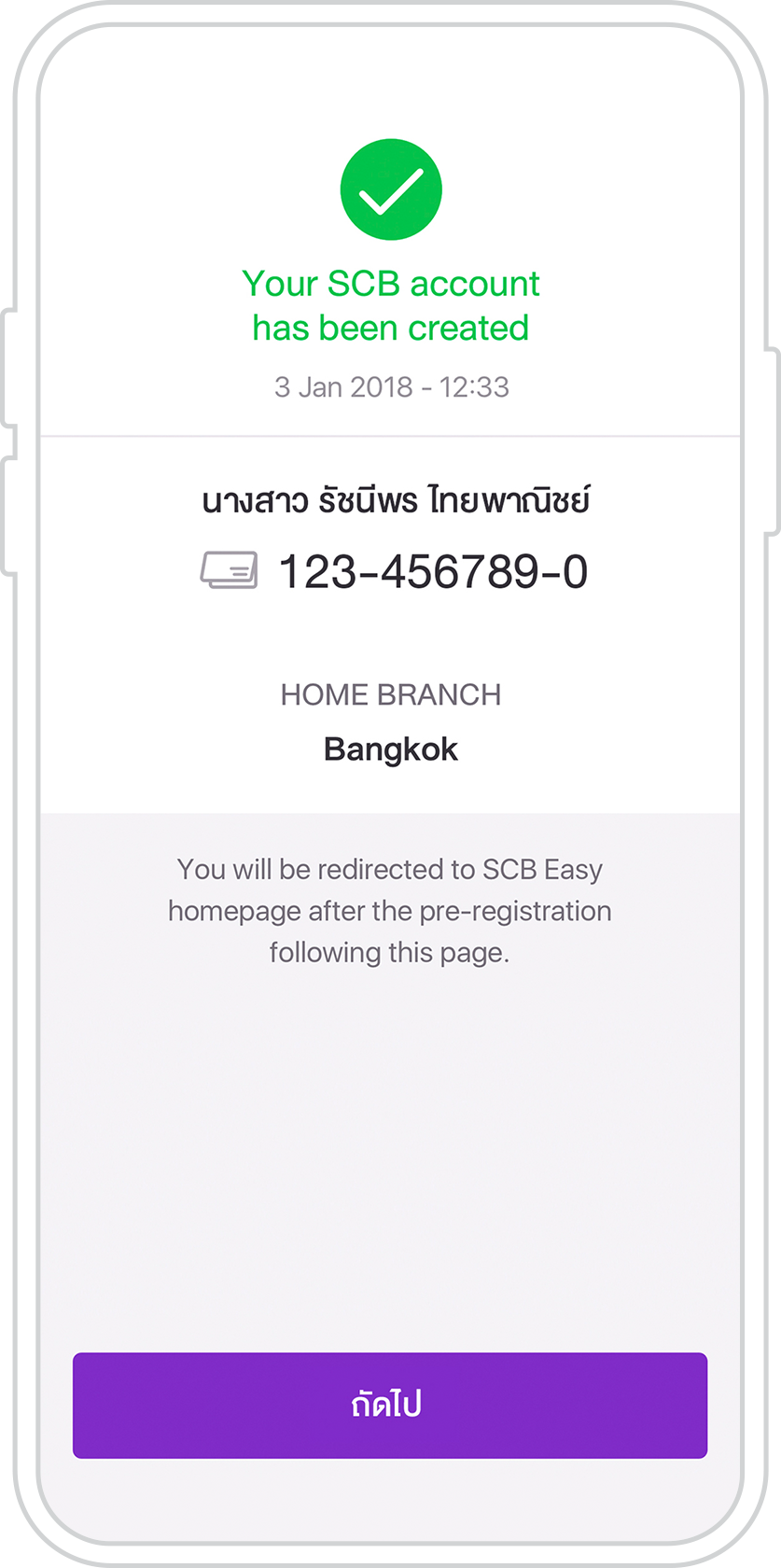

12. The account is successfully opened. Tap “Next” to accept the terms and conditions and confirm the OTP.

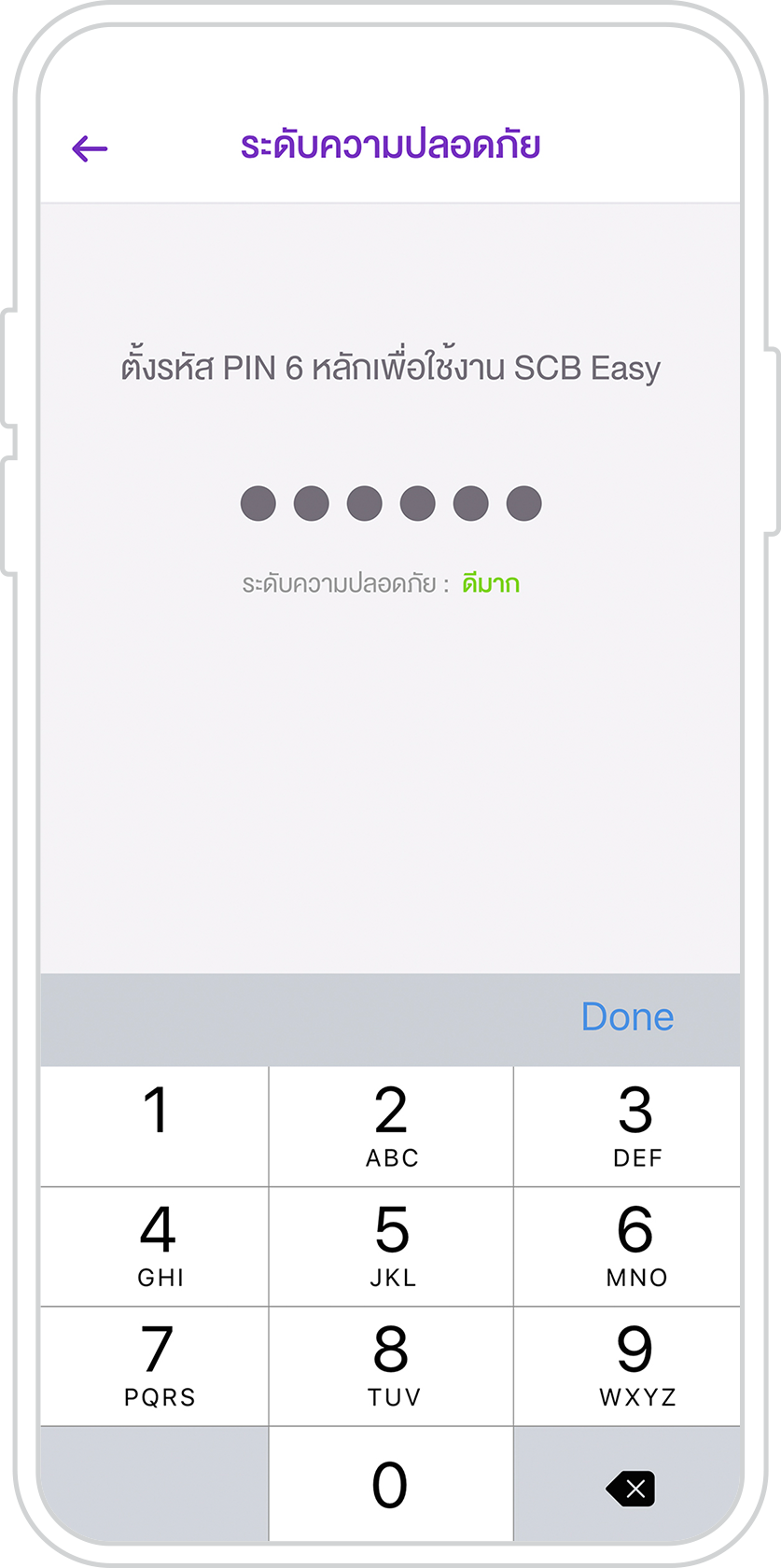

13. Set a 6-digit PIN.

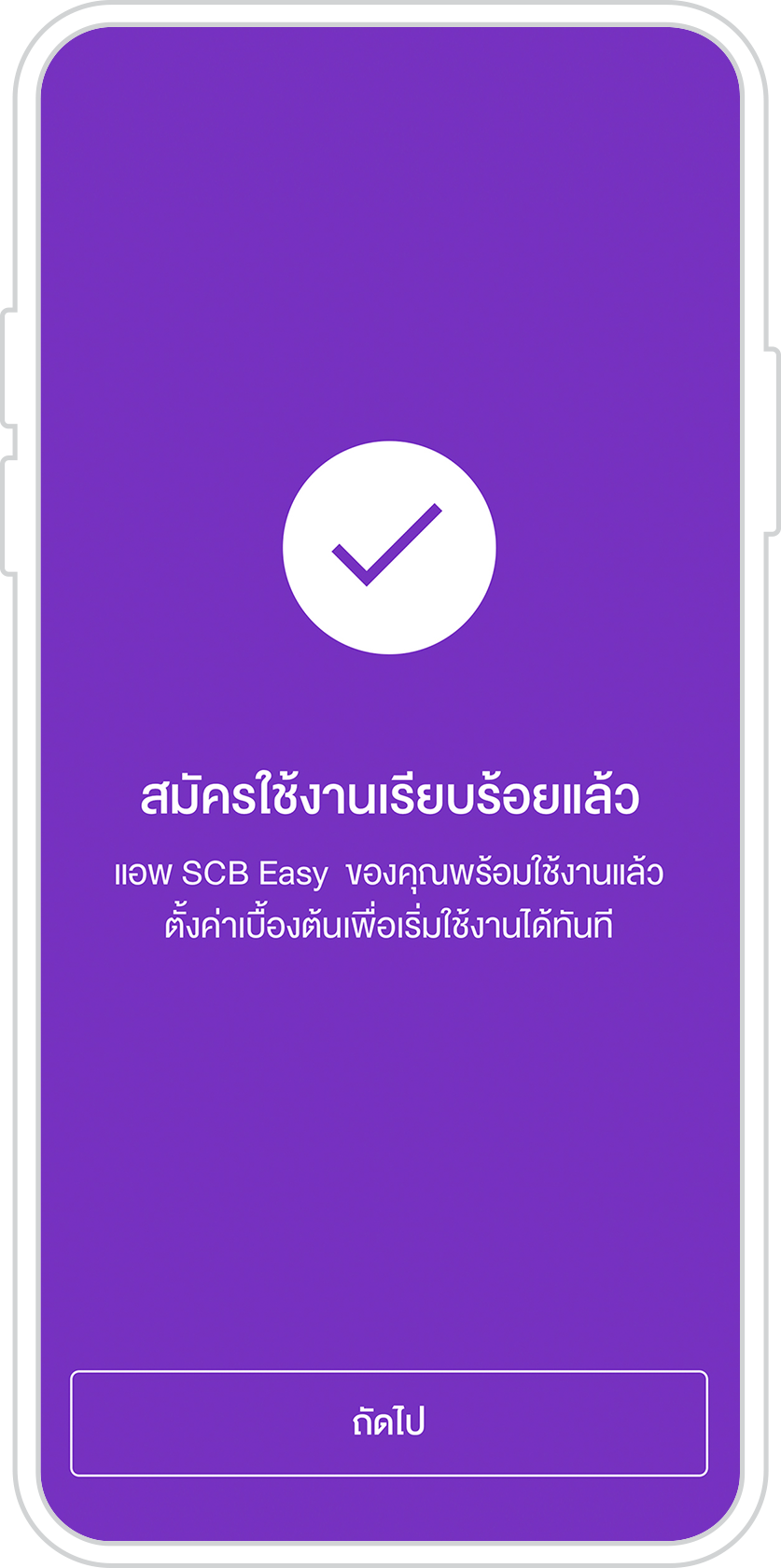

14. Successful transaction. Tap “Next” to start using.

What you need for account opening

SCB EASY app

For account opening

Your National ID Card

For identity authentication

Your mobile phone number

For receiving an OTP

Service terms and conditions

Account opening

- Proceed with identity authentication via the selected bank within 1 hour

- Proceed with identity authentication information via SCB EASY within 24 hours

- Account opening is available via the SCB EASY app during 07:00 am – 10:30 pm.

Transactions and fees

- On the SCB EASY app and Internet banking (SCB Easy Net): No fee for fund transfers from your online savings account to other accounts and cardless ATM cash withdrawals.

- At SCB branches:

- Cash and cheque deposits

- Withdrawals

- Fund transfers

- Request to add your signature

- Apply for an ATM or debit card

- Close the account

- At SCB ATMs/CDMs: Cash deposits and cardless ATM cash withdrawals