I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

Reinforcing the Bank’s Digital Banking Leadership, SCB introduces Electronic Foreign Currency Deposit (e-FCD) accounts with interest rates of up to 4% p.a.* which can be conveniently opened on the SCB EASY app. Available in 5 major currencies.

Siam Commercial Bank (SCB) continues its Digital Bank with a Human Touch strategy, aiming to expand wealth management services with its digital wealth model driving the organization toward becoming an AI-First Bank. It is now moving forward to tap the Emerging Wealth market, targeting a new generation of potential customers who want to create wealth from the start. To further that goal, the bank has introduced Electronic Foreign Currency Deposit (e-FCD) Savings Accounts on the SCB EASY app for Thai individuals. The new savings accounts target digital savvy customers looking for smart savings or new forms of investment. As a launch promotion, SCB is offering a special interest rate of up to 4% p.a.* without fixed deposit or minimum deposit requirements. The e-FCD savings accounts are available in five major currencies: USD, GBP, EUR, SGD, and CNY. No transaction fees**. The SCB EASY app is a convenient, fast, and all-in-one app.

SCB is confident that these new e-FCD savings accounts will offer opportunities to create long-term wealth for everyone, opening the door to future investments in foreign markets while responding to foreign currency transaction needs. SCB continues to develop innovative financial solutions to provide customers with a seamless investment experience through digital channels.

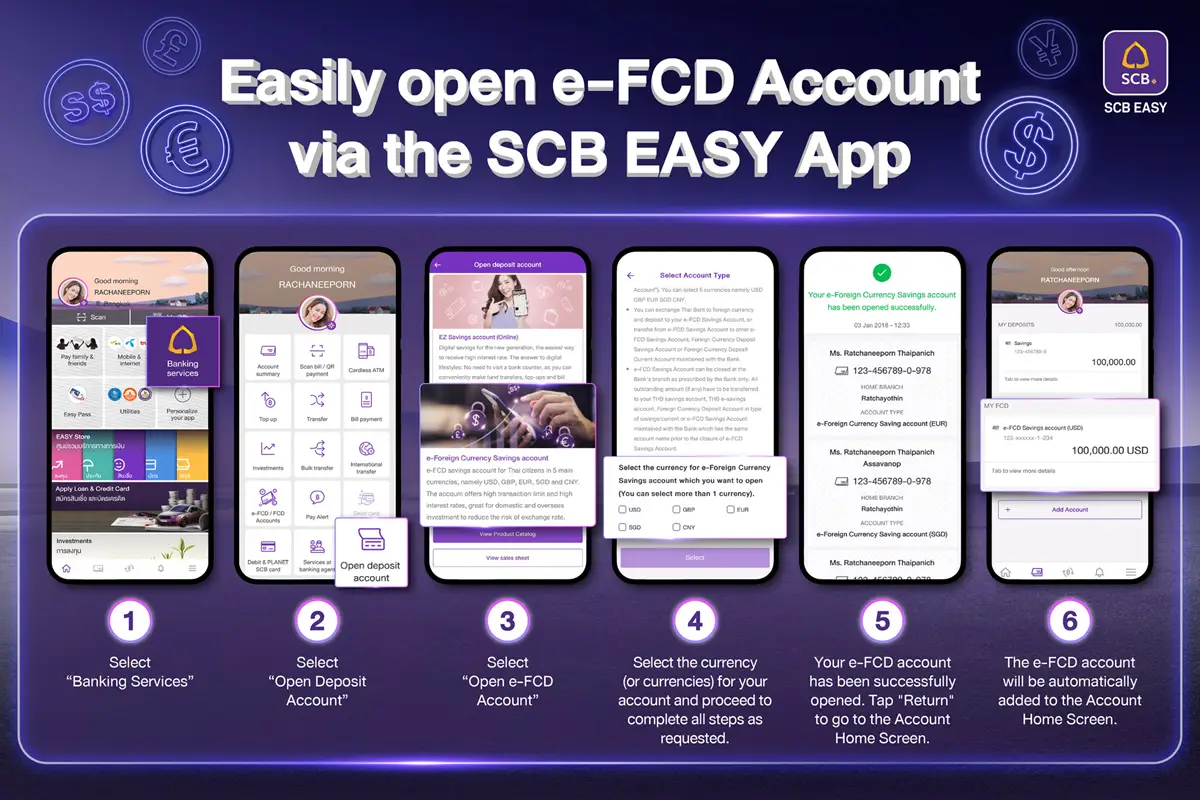

How to open an “e-FCD account” on the SCB EASY app

- Select “Banking Services.”

- Select “Open Deposit Account.”

- Select “Open e-FCD Account.”

- Select the currency (or currencies) for your account and proceed to complete all steps as requested.

- Your e-FCD account has been successfully opened. Tap "Return" to go to the Account Home Screen.

- The e-FCD account will be successfully added to the account home screen. You can now start exchanging foreign currencies on the SCB EASY app.

Interested customers can obtain more details by contacting the SCB Call Center at 02-777-7777, visiting any SCB branch nationwide, or by finding more details at https://www.scb.co.th/th/personal-banking/deposits/foreign-currency-deposit/e-fcd

Remarks:

- *Special deposit interest rate of up to 4% p.a. for USD only for the period from 22 November 2024 to 28 February 2025. From 1 March 2025, the rate will revert to the normal interest rate of 0.15% p.a.

- For interest rates for deposits in GBP, EUR, SGD and CNY currencies, please see more details on the bank's website.

- SCB reserves the right to modify deposit interest rates. Conditions are as announced by the bank.

- e-FCD accounts carry foreign exchange rate risk. Customers are advised to carefully review the product details and terms before making a decision.

- e-FCD accounts must comply with Bank of Thailand regulations.

- **No fees for foreign exchange and fund transfers until further notice by the Bank.