I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

SERVICES

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

SCB supports the “You Fight, We Help” project, helping vulnerable customers, fostering discipline, and solving household debt sustainably

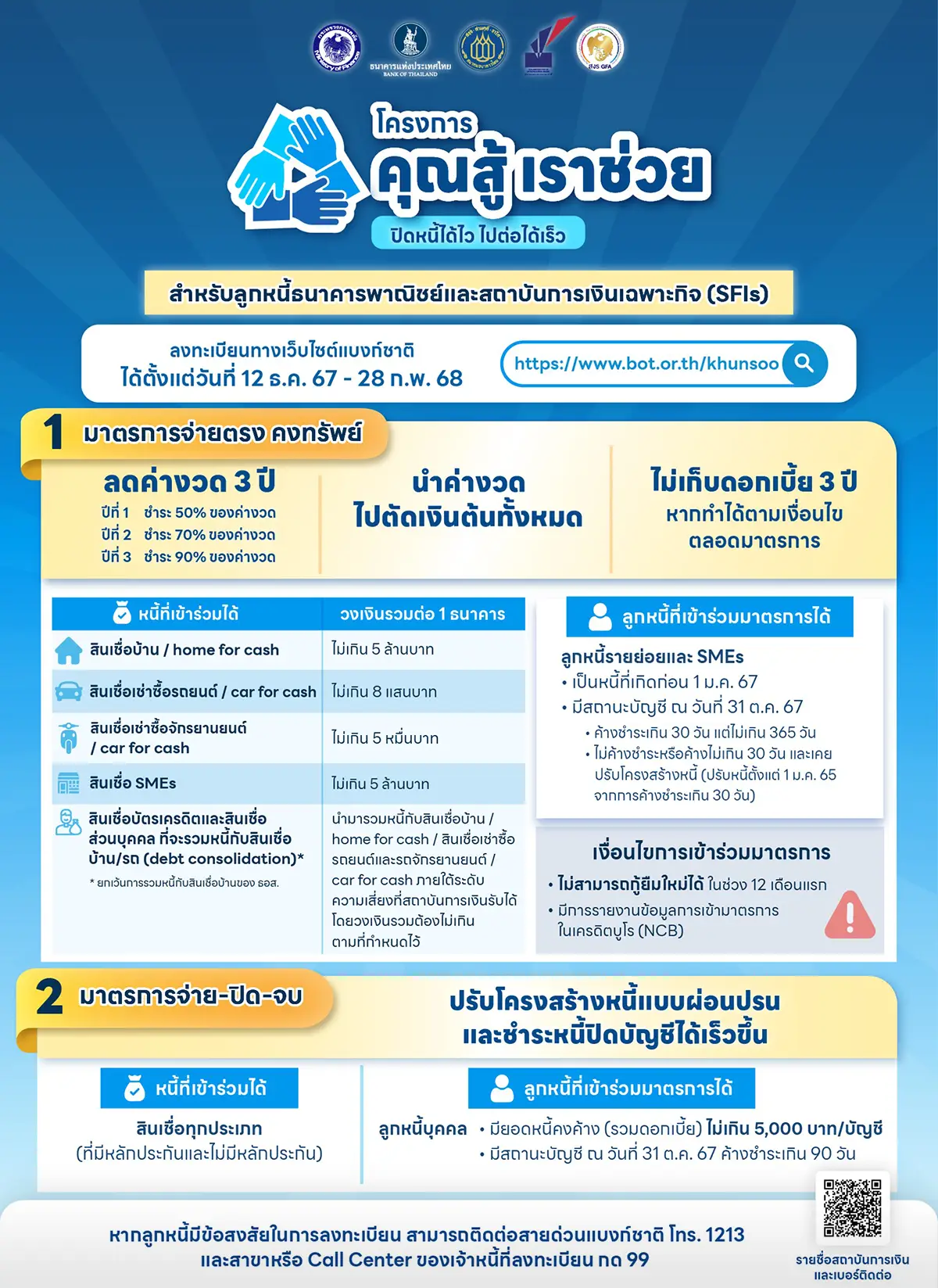

In response to the collaborative initiative between the Ministry of Finance, the Bank of Thailand, and the Thai Bankers Association to assist retail and SME debtors through the “You Fight, We Help” campaign, Siam Commercial Bank (SCB) is committed to supporting retail customers and SME clients with home loans, car loans, and SME loans. Customers and clients seeking assistance can register via the Bank of Thailand’s website at www.bot.or.th/khunsoo from 12 December 2024 to 28 February 2025.

SCB Chief Executive Officer Mr. Kris Chantanotoke stated that SCB has been providing relief to all customer segments through various ongoing measures, aiming to help them regain their ability to work and operate their businesses at full potential. However, the persistent issue of household debt, exacerbated by the COVID-19 pandemic and the current economic situation, has left some retail customers and SME clients unable to fully recover. To address this, the government and private sectors, including the Ministry of Finance, the Bank of Thailand, and the Thai Bankers Association, have partnered to introduce additional relief measures for retail and SME debtors under the “You Fight, We Help” campaign. The initiative targets three vulnerable debtor groups: 1. Home loan debtors with a total credit line of up to 5 million baht; 2. Car hire-purchase loan debtors with a total credit line of up to 800,000 baht; and 3. SME loan debtors with a total credit line of up to 5 million baht. For these individuals and businesses with lower credit lines, the measures aim to reduce their installment and interest burdens, provided they maintain financial discipline and meet payment conditions for consecutive three years. This will help them recover, repay their debts, and retain their homes, vehicles, and business premises.

Customers and clients seeking support can register free via the Bank of Thailand’s website at www.bot.or.th/khunsoo from 12 December 2024 to 28 February 2025., 2025. Banks will begin contacting registrants from 2 January 2025, onwards. For more information about the campaign and registration, please visit the Bank of Thailand’s website, or contact the Bank of Thailand’s Call Center at 1213 or the SCB Call Center at 0 2777 7777, press 99.

Meanwhile, SCB encourages customers and clients to continue making repayments as usual to maintain a positive repayment history. By participating in the campaign and adhering to the payment conditions for three years, they will receive the benefits outlined in the initiative.

For customers and clients unable to join the campaign, SCB offers assistance through its own responsible and fair lending practices. They can contact an SCB branch, the Call Center, or their Business Relations Manager to request support.

Steps to Register for the "Khun Soo, Rao Chuai" Program via the Bank of Thailand Website

Registration is open from December 12, 2567 to February 28, 2568.