I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

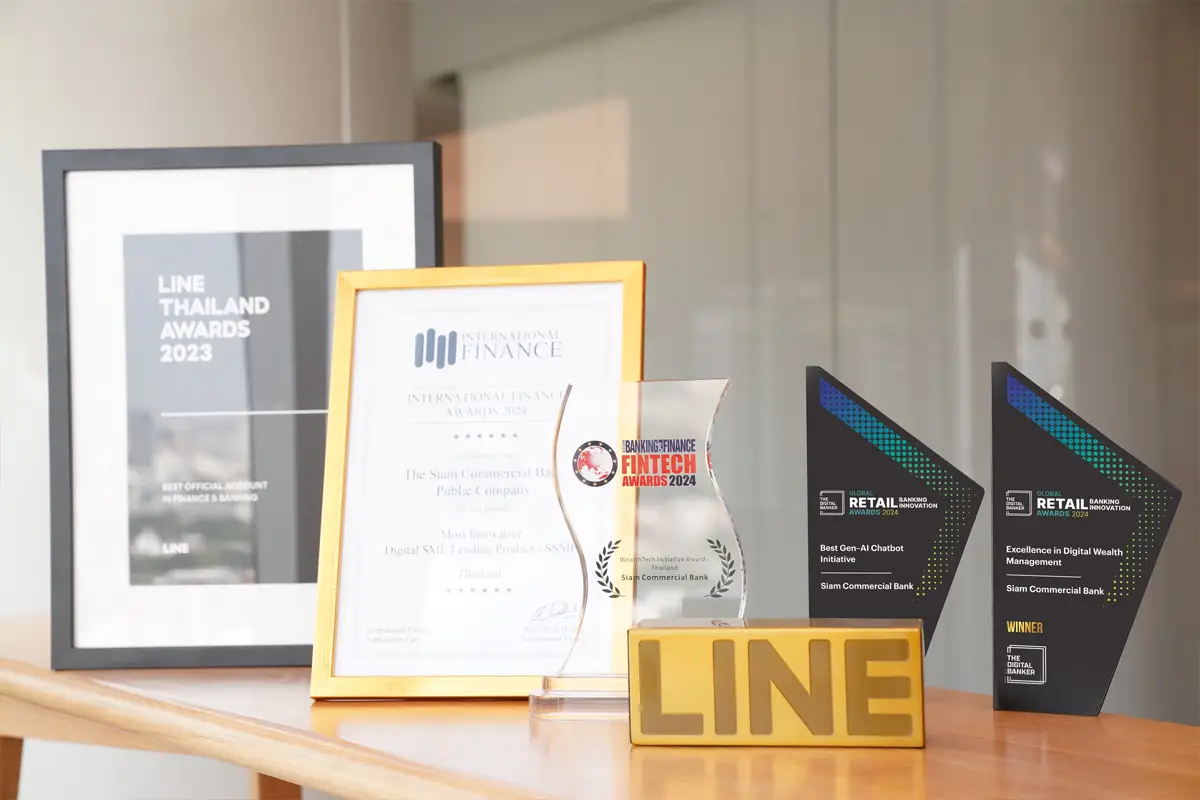

SCB sweeps five international financial product and innovation awards, reinforcing its digital bank leadership with continuous outstanding performance.

Siam Commercial Bank continues its Digital Bank with a Human Touch strategy, aiming to become an AI-First bank by using AI technology to drive the organization 360 degrees in product development, service integration, and work process improvement under a Better Brain model. A recent successful AI innovation development that offers a full digital banking experience is retail loan approval powered 100% by AI for digital loans for small entrepreneurs (digital SSME lending). This innovation facilitates loan approval for clients in just 3 easy steps, no documents required, and with approval results in as little as 10 minutes. AI and machine learning for risk assessment are used to determine appropriate interest rates for clients. As a result, more than 180,000 small entrepreneurs were able to access loans more conveniently.

In addition, the bank has further developed AI innovations and data analytics models featuring intelligent data models and in-depth customer data analytics. These can be found on the SCB EASY app’s Easy Store service, a financial service hub tailored just for you. Currently, Easy Store offers Contextual Messages, a feature that can recommend, notify, and build personalized relationships, as well as present sustainable products like the ESG Solar Roof, providing a convenient option for using clean energy. This marks the beginning of a sustainable future and drives the goal of Net Zero 2050. Additionally, the LINE SCB Connect platform leverages hyper-personalized insights to create and offer digital financial products that meet customer needs in a precise and timely manner. The investment experience through the SCB EASY app has been enhanced with comprehensive Digital Wealth services, including an AI Advisory Chatbot, MyAlert, and WEALTH4U. With innovative solutions like the electronic Foreign Currency Deposit (e-FCD) account available on the SCB EASY app, users can explore new investment avenues and smart saving strategies. These services respond to the needs of younger generations seeking to grow their wealth by creating opportunities to increase everyone’s long-term wealth.

All of these services reflect the potential of leveraging AI and machine learning technology to create a digital lifestyle ecosystem. SCB has developed services through customer insights and understanding their needs, resulting in the bank receiving five awards for excellence in financial products and innovations from four leading world-class institutions. SCB First Executive Vice President, Head of Digital Business, Ms. Pitiporn Phanaphat recently announced this success.

The five awards for excellence in financial products and innovations granted to SCB are as follows:

- International Finance Award 2024, in the category of Most Innovative Digital SME Lending Product (SSME) from the Digital SSME Lending products

- Best LINE OA in Finance & Banking 2023 by LINE Thailand for the SCB Connect LINE OA

- Global Retail Banking Innovation Awards 2024, in the category of Best Gen-AI Chatbot Initiative from Digital Wealth – AI Advisory Chatbot

- Asian Banking & Finance FINTECH Awards (ABF) 2024, in the category of WealthTech Initiative Award from the MyAlert service

- Global Retail Banking Innovation Awards 2024, in the category of Excellence in Digital Wealth Management, from the WEALTH4U service